Professional Photography Invoice Template - Free Download

Create professional photography invoices in 30 seconds. Wedding packages, portrait sessions, commercial licensing, and usage rights billing. Mobile invoicing for photographers.

Create professional photography invoices in 30 seconds. Wedding packages, portrait sessions, commercial licensing, and usage rights billing. Mobile invoicing for photographers.

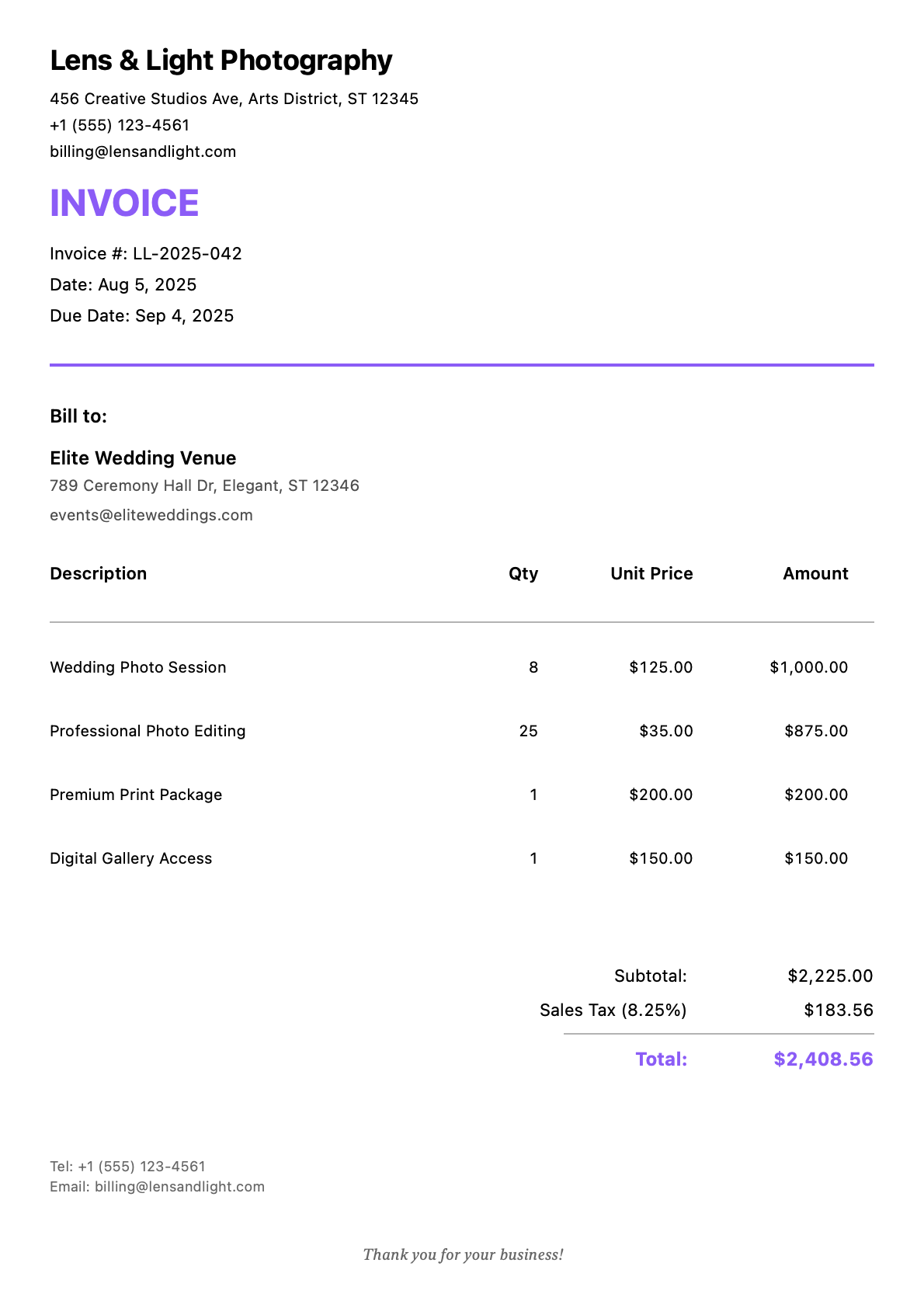

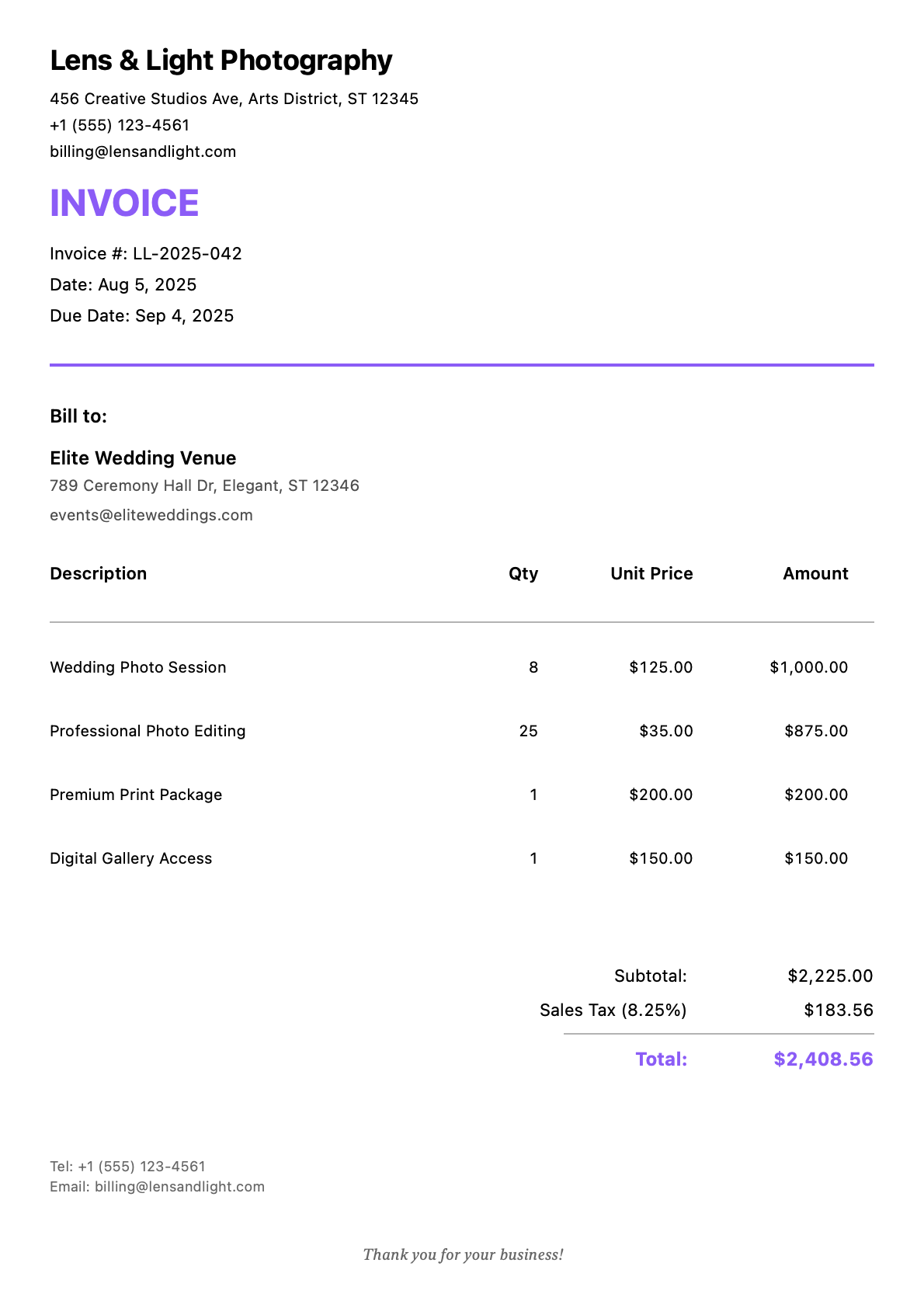

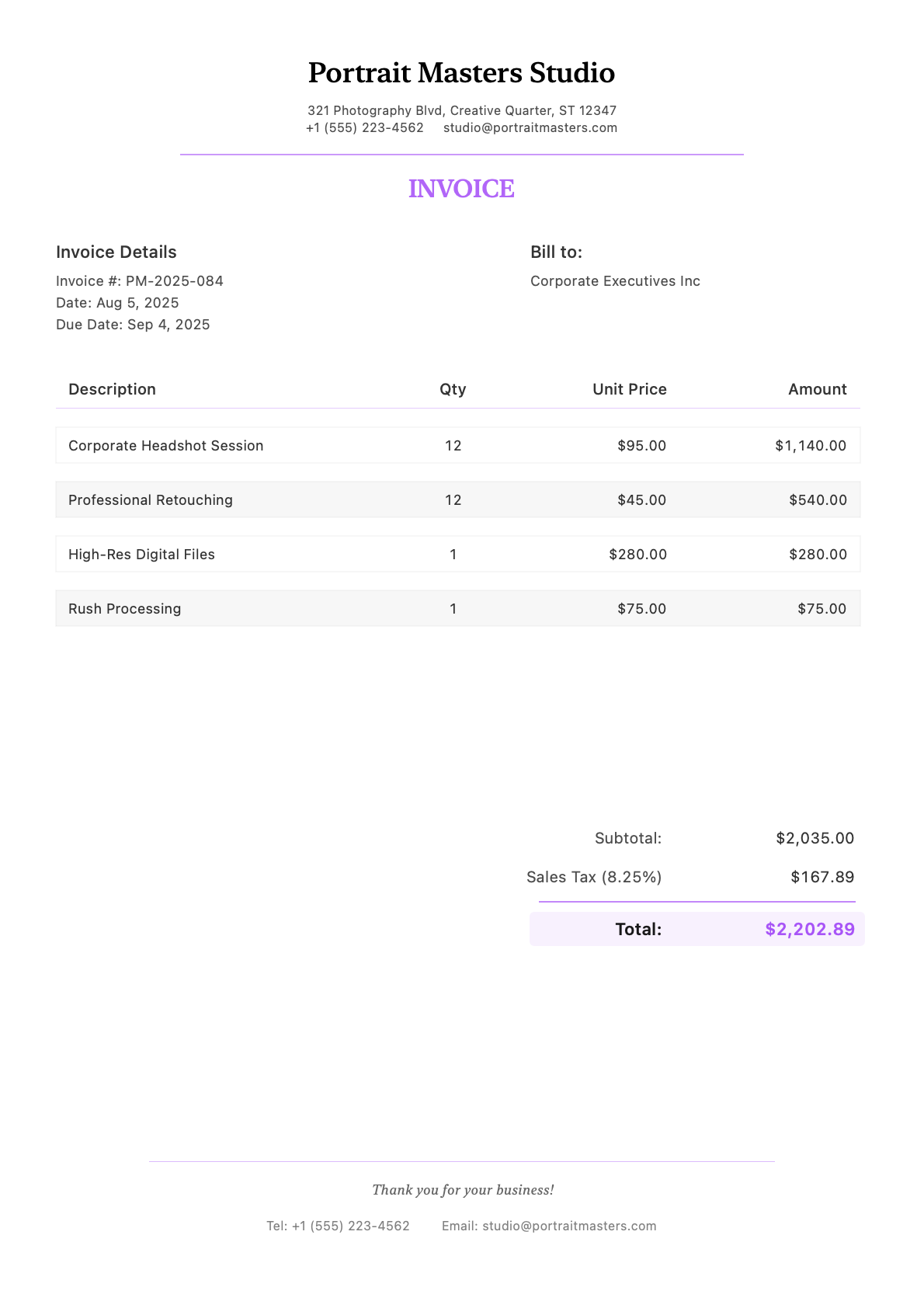

Professional invoice templates designed specifically for photography services. Each example uses realistic project details and industry-standard pricing.

Create invoices on-site using your iPhone or iPad. No desktop required.

From project details to professional PDF in under 30 seconds.

Industry-specific templates with your branding and color scheme.

You just delivered a stunning gallery of wedding photos. The couple is thrilled, sharing previews on social media, tagging you in every story. This is your moment—your work is being celebrated. Now you need to get paid for it.

Most photographers undercharge because they focus only on shooting time. But you’re not just selling 8 hours at a wedding—you’re selling weeks of editing, years of skill development, and equipment that costs as much as a car. Your invoice should reflect the full scope of value you deliver.

Photography pricing is notoriously confusing to clients. They see “4-hour photo session: $2,000” and think you make $500/hour. Your invoice should break down the true scope of work while protecting your intellectual property.

Common photography billing challenges:

| Service Type | Description | Typical Rate Range |

|---|---|---|

| Portrait Session (1 hr) | Individual/couple/family portraits | $150 - $500 |

| Headshot Session | Corporate or professional headshots | $150 - $400/person |

| Wedding Coverage | Full day wedding photography | $2,500 - $10,000+ |

| Event Photography | Corporate events, parties | $150 - $350/hour |

| Commercial Session | Product, food, architecture | $250 - $1,000/hour |

| Photo Editing | Per-image professional retouching | $15 - $50/image |

| Digital File Delivery | High-res files via gallery | $100 - $500 |

| Print Products | Albums, canvases, prints | Varies (40-60% margin) |

| Rush Processing | Expedited delivery | $100 - $500+ |

| Travel Fee | Location shoots beyond local area | $50 - $150 + mileage |

| Usage License | Commercial/extended rights | 50-300% of session fee |

This is where many photographers lose money.

When a client pays for a photo session, they’re typically getting:

Standard Personal Use License:

Commercial License (Additional Fee):

Invoice Language: Your invoice should note the license granted:

“Images provided under personal use license. Commercial usage requires separate licensing agreement. Contact photographer for commercial rates.”

Package Pricing (Recommended for Events) Bundle session time, editing, and deliverables:

Packages simplify client decisions and protect your hourly rate.

À La Carte (Recommended for Commercial) Itemize each component separately:

This transparency helps commercial clients understand value and budget.

In the United States:

Common Photography Deductions:

For Wedding/Event Photographers:

Break Down the Full Scope of Work Don’t just show “Wedding Photography: $5,000.” Show the value:

Even if it totals the same amount, itemization helps clients understand they’re getting far more than “taking pictures.”

State Deposit and Payment Terms Clearly For events, use a payment schedule:

This protects both parties and sets clear expectations.

Include Usage Rights on Every Invoice Add a line item or note specifying the license:

This prevents confusion and protects your ability to license the same images later.

Should I require a deposit for all bookings? Yes, especially for events. A 25-50% non-refundable deposit secures the date and covers your opportunity cost if the client cancels. For smaller sessions (headshots, portraits), a smaller deposit or full prepayment is reasonable. Always clearly state deposit and refund policies on your invoice.

How do I price commercial usage licenses? Base it on scope: how long, where, and how prominently the images will be used. A local business using one image on their website for a year might pay 50% of the session fee. A national ad campaign using multiple images could be 200-300% of the session fee or more. When in doubt, research stock photo licensing prices for similar usage.

What’s the best way to handle print orders? Invoice print orders separately from the session. Offer curated print packages at a premium (40-60% margin is standard), or allow à la carte ordering at slightly lower margins. Include a “print credit” in packages to encourage print sales. Invoice when the order is placed, not when it ships.

How should I invoice for album design vs. album printing? Separate them. “Album design (40 spreads): $500” and “12x12 Leather Album printing: $800.” This shows the creative work is valuable, and clients can upgrade album materials without feeling like they’re paying for design twice. If they want revisions beyond included rounds, invoice those separately too.

Do I need to charge sales tax on digital files? It depends on your state. Some states tax digital goods, others don’t. Some tax the “tangible personal property” (prints, USBs) but not digital delivery. This is genuinely confusing—consult a local accountant familiar with creative businesses. When in doubt, collect the tax and let the state sort it out.

Ready to get paid what your photography is worth? Download InvoiceZap and create professional invoices in 30 seconds.

Join thousands of photography using InvoiceZap

Create Your Photography Invoice Now