Professional Personal Training Invoice Template - Free Download

Create professional personal training invoices in 30 seconds. Session packages, nutrition coaching, and group training billing. Mobile invoicing for fitness professionals.

Create professional personal training invoices in 30 seconds. Session packages, nutrition coaching, and group training billing. Mobile invoicing for fitness professionals.

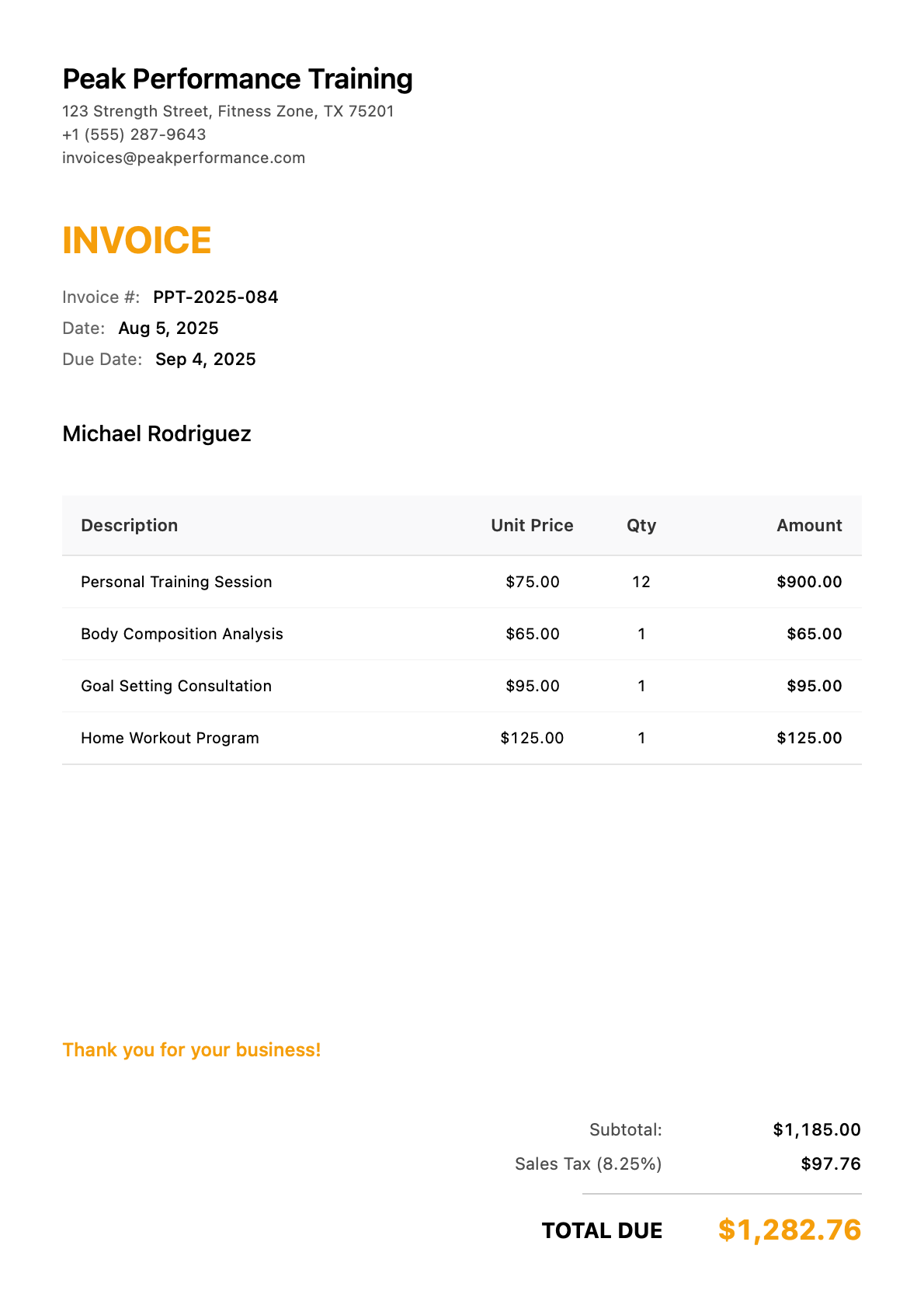

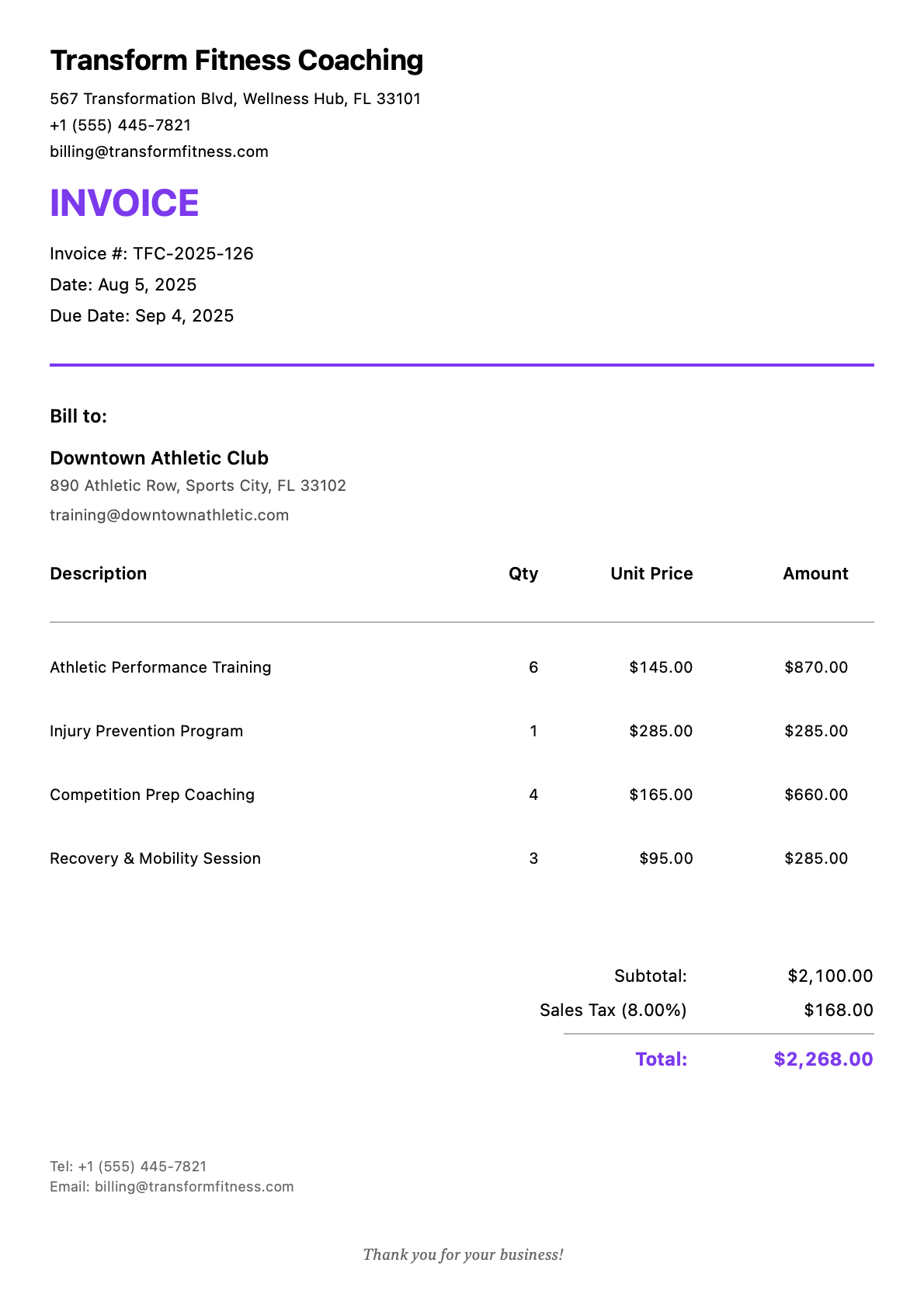

Professional invoice templates designed specifically for personal training services. Each example uses realistic project details and industry-standard pricing.

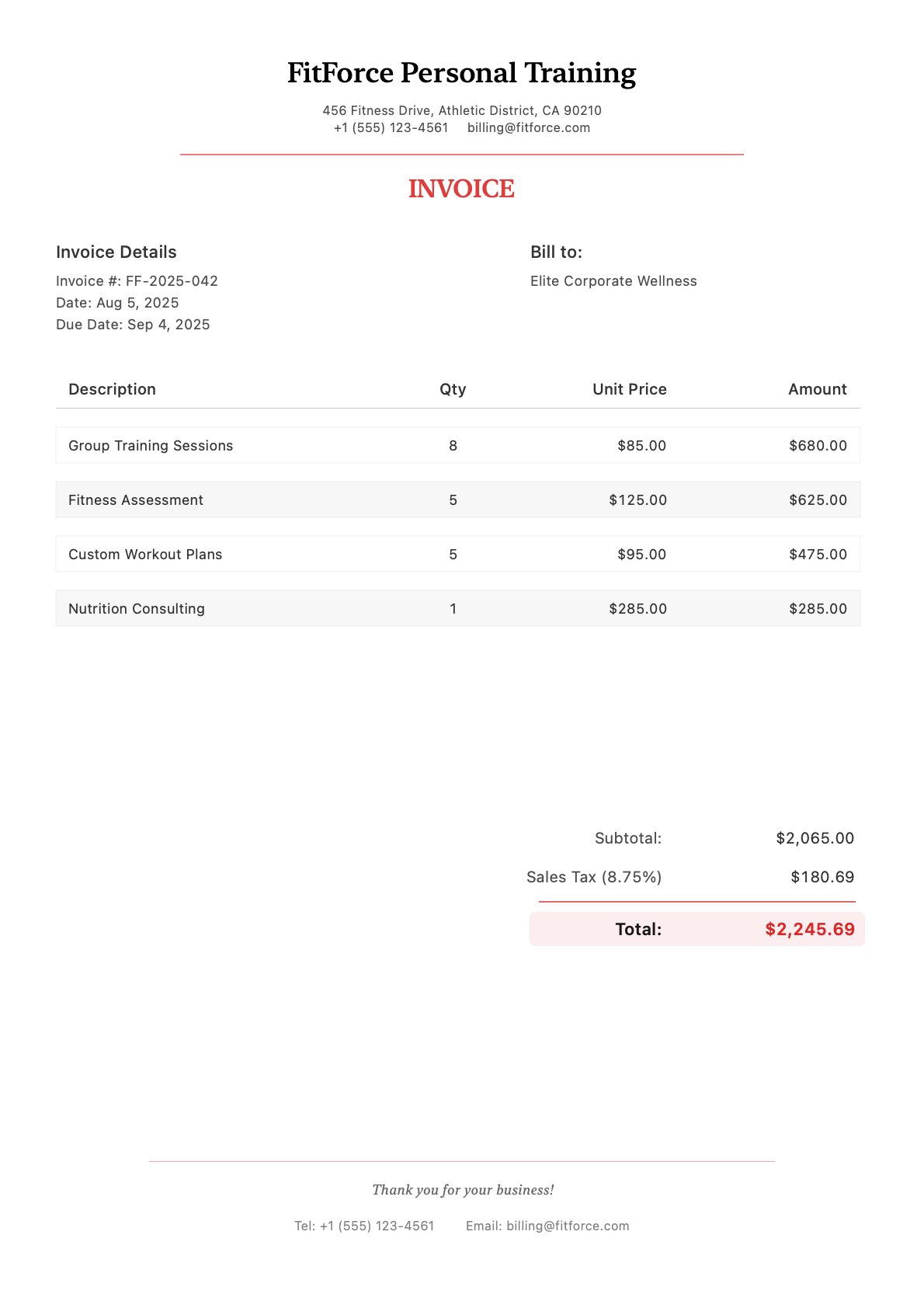

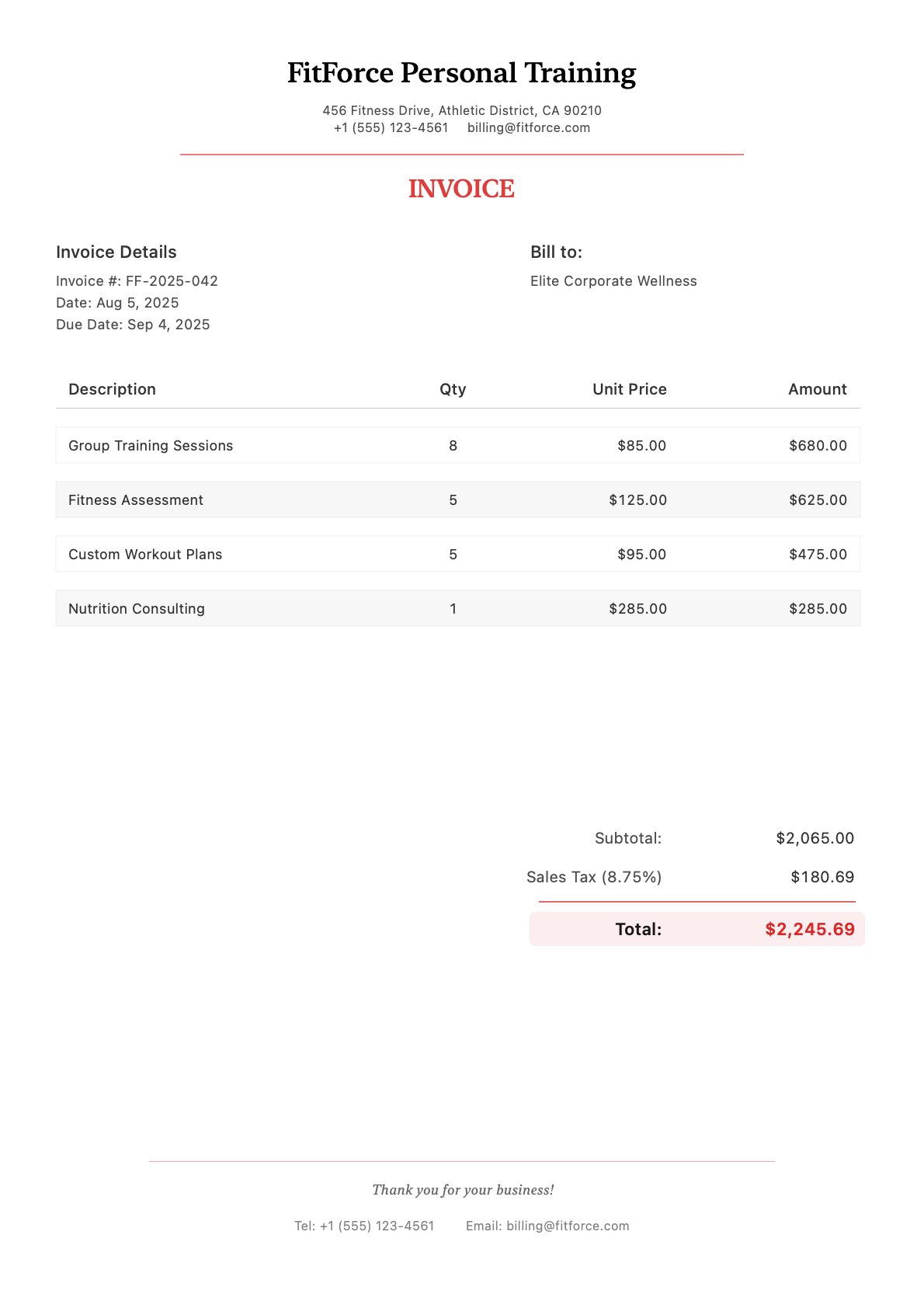

Client: Elite Corporate Wellness

Invoice #FF-2025-042

Create Similar Invoice

Create invoices on-site using your iPhone or iPad. No desktop required.

From project details to professional PDF in under 30 seconds.

Industry-specific templates with your branding and color scheme.

Your client just crushed a PR on their deadlift. They’re riding high on endorphins, thanking you for pushing them. This is the perfect moment to hand them a professional invoice—not fumble with a spreadsheet later when the motivation has worn off.

Most personal trainers are great at programming workouts but terrible at business admin. You got into fitness to help people transform their lives, not to chase payments. A polished invoice that arrives right after a great session reinforces the value you deliver and makes getting paid feel natural.

Fitness professionals have unique billing scenarios: session packages, expiring credits, add-on services, and hybrid offerings that mix in-person and virtual training. Generic invoices don’t capture this complexity.

Common personal training billing challenges:

| Service Type | Description | Typical Rate Range |

|---|---|---|

| 1-on-1 Session (Gym) | Individual training at gym facility | $50 - $150/hour |

| 1-on-1 Session (In-Home) | Training at client’s location | $75 - $200/hour |

| Virtual Training Session | Live video coaching session | $40 - $100/hour |

| Partner Training | 2 clients, same session | $80 - $175/hour (total) |

| Small Group (3-5) | Semi-private training | $25 - $50/person/session |

| Large Group Class | Boot camp, outdoor classes | $15 - $30/person |

| Fitness Assessment | Initial evaluation and testing | $75 - $200 |

| Custom Workout Program | Written training plan | $100 - $300/program |

| Nutrition Coaching | Meal planning and guidance | $100 - $250/month |

| Competition Prep | Bodybuilding/athletic event prep | $150 - $300/session |

Session Packages (Most Common) Sell blocks of sessions at a per-session discount:

Invoice the full package upfront and track remaining sessions.

Monthly Retainer For clients training 3+ times per week, a monthly flat rate works well:

Hybrid Packages Combine in-person sessions with virtual support:

In the United States:

For Independent Trainers:

Session Package Tax Timing:

Show Package Value and Savings Instead of just listing the package price, show what they’re getting:

This reinforces the smart decision they made buying the package.

Track Session Usage For prepaid packages, include a running balance:

This prevents disputes and encourages rebooking before sessions expire.

Separate Add-On Services Clearly If you add nutrition coaching or a custom program to a training package, itemize them separately:

Clients understand the total value and can choose what they want.

Should I require full payment upfront for session packages? Yes. Prepaid packages improve cash flow and client commitment. Clients who pay upfront are more likely to show up consistently. Offer a small discount (10-15%) to incentivize prepayment, and clearly state your no-refund or prorated-refund policy.

How do I handle no-shows and late cancellations? State your cancellation policy on every invoice and in your client agreement. Common policies: 24-hour notice required, late cancellations forfeit the session, or late cancellations charged at 50%. When charging for a no-show, invoice it as “Late Cancellation Fee” or “Missed Session Charge.”

What’s the best way to invoice for virtual training add-ons? Bundle virtual check-ins into your package price, or charge them as a separate monthly fee. For example: “In-Person Training (4 sessions): $300” plus “Virtual Coaching Support: $100/month.” This makes the virtual component feel valuable, not throwaway.

How should I price in-home training vs. gym sessions? In-home training should be 30-50% higher than gym sessions to account for travel time, equipment transport, and the convenience you’re providing. State this clearly: “In-Home Session: $110” vs. “Gym Session: $75.” Clients understand the premium for convenience.

Should I invoice after each session or at the end of the month? For prepaid packages, invoice when they purchase the package. For pay-as-you-go clients, invoice immediately after each session—while the workout high is still fresh. Monthly invoicing works for retainer clients with recurring monthly rates.

Ready to run your training business like a pro? Download InvoiceZap and create your first professional fitness invoice in 30 seconds.

Join thousands of personal training using InvoiceZap

Create Your Personal Training Invoice Now