Professional Consulting Invoice Template - Free Download

Create professional consulting invoices in 30 seconds. Download free templates or use our mobile app for instant PDF generation.

Create professional consulting invoices in 30 seconds. Download free templates or use our mobile app for instant PDF generation.

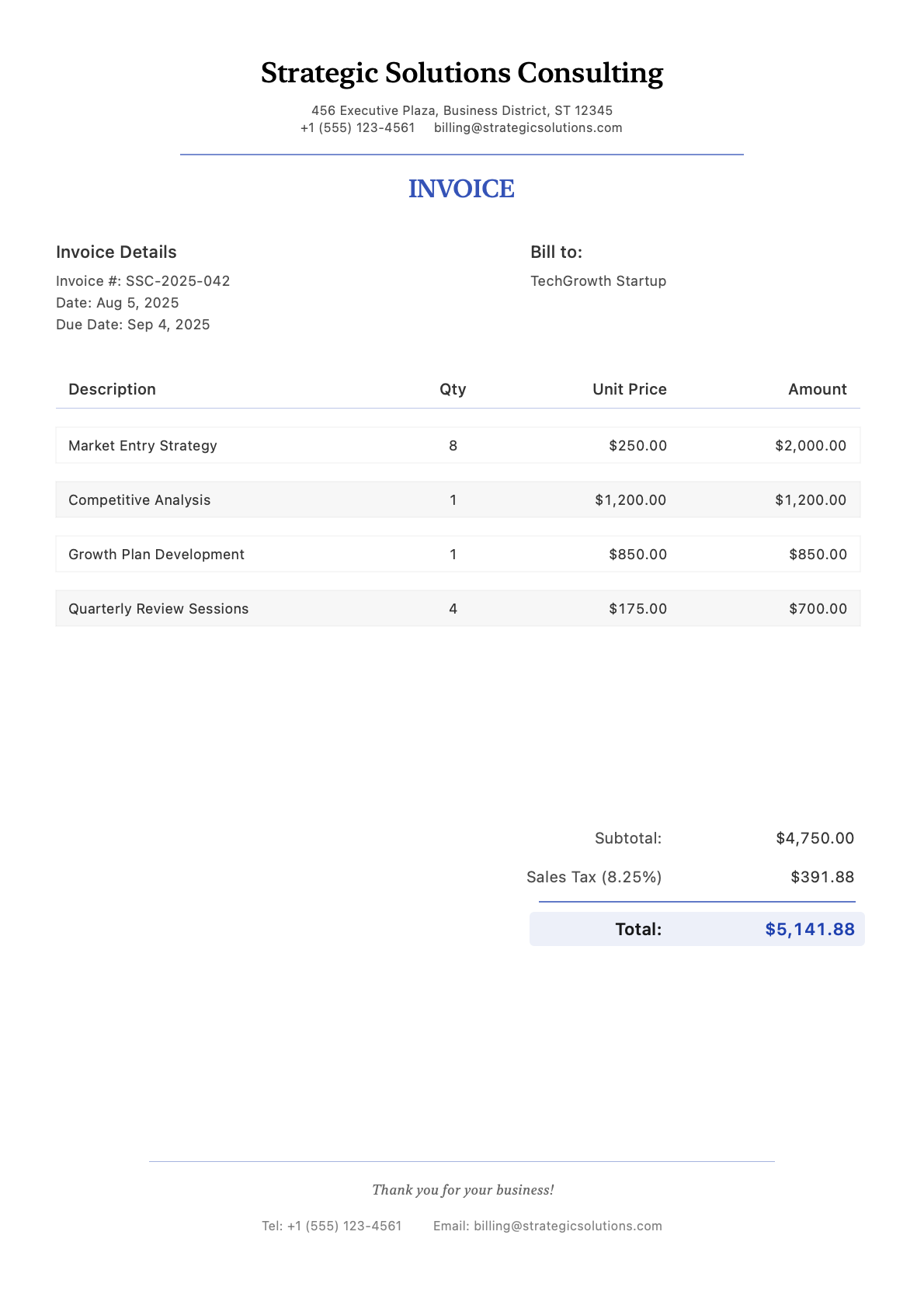

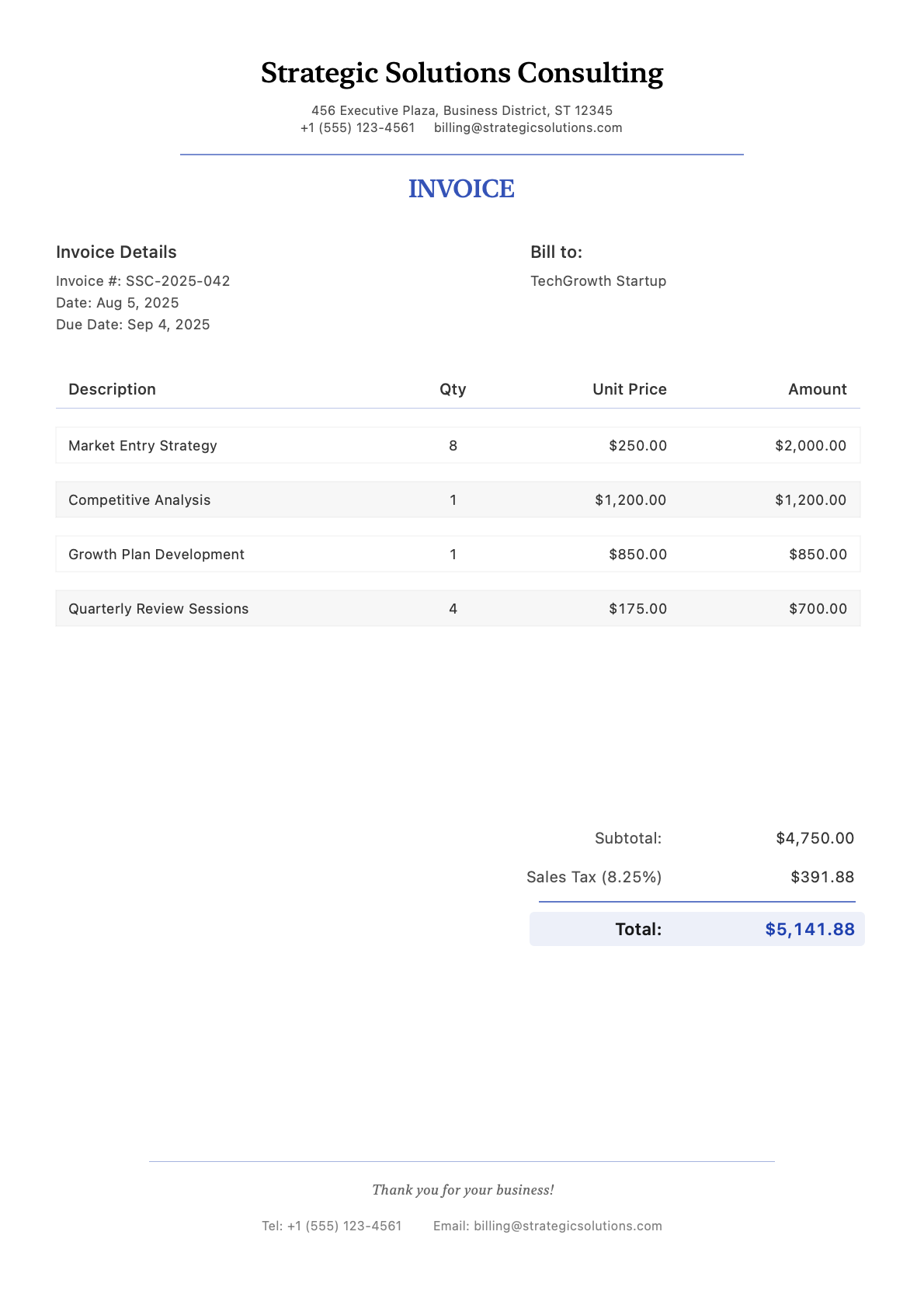

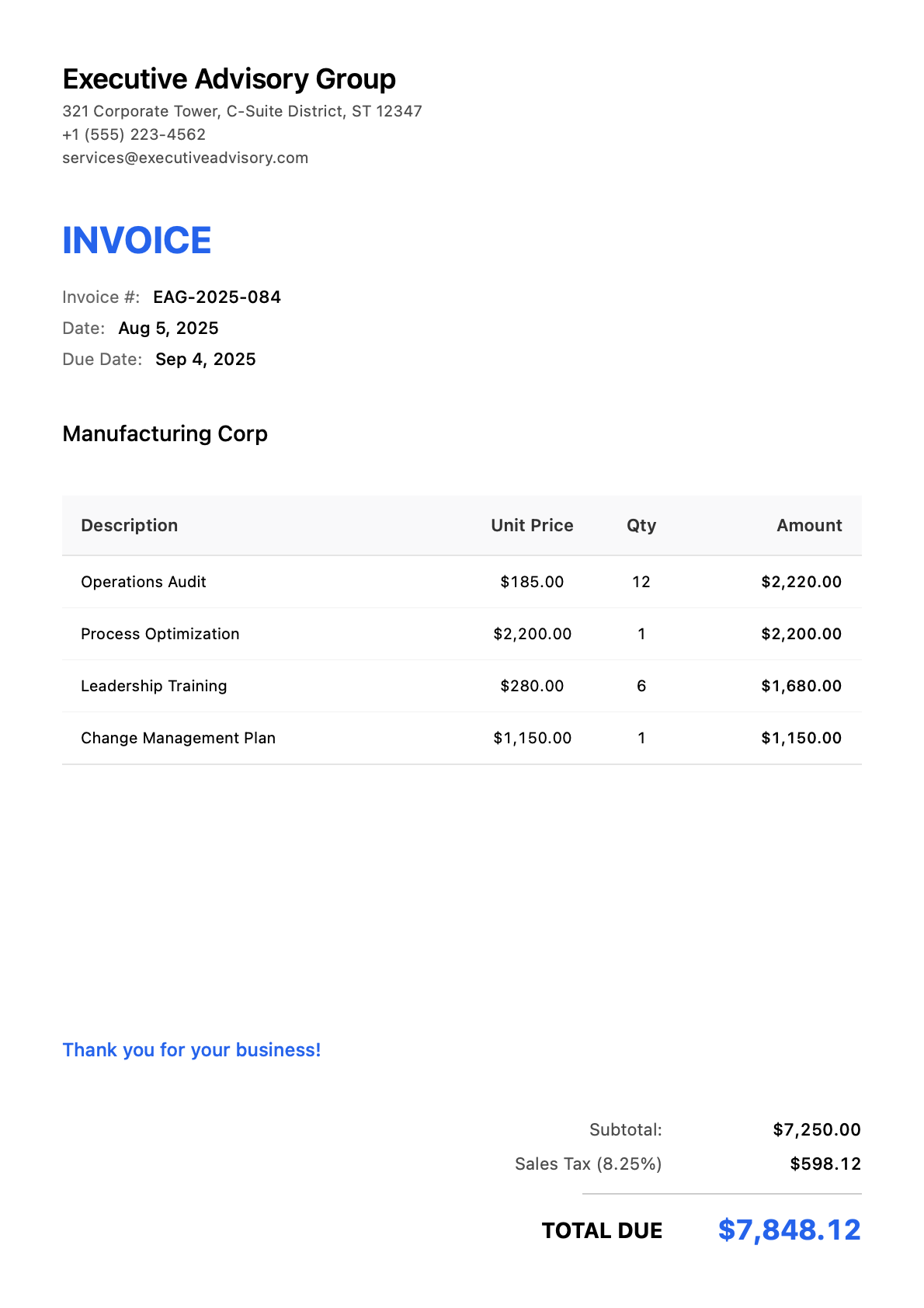

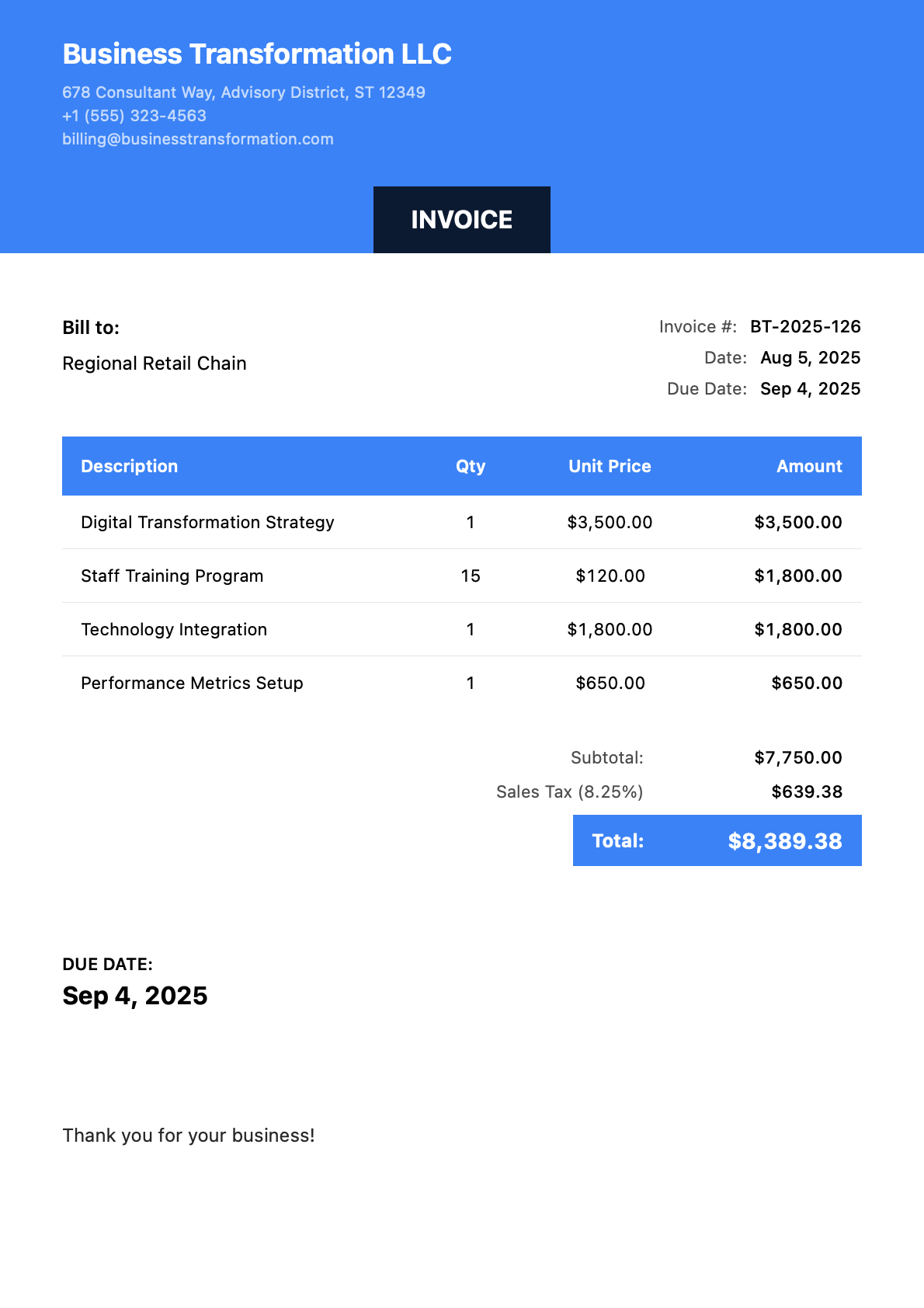

Professional invoice templates designed specifically for consulting services. Each example uses realistic project details and industry-standard pricing.

Create invoices on-site using your iPhone or iPad. No desktop required.

From project details to professional PDF in under 30 seconds.

Industry-specific templates with your branding and color scheme.

You just wrapped up a strategy session that could transform your client’s business. You’ve delivered insights worth thousands of dollars. Now comes the awkward part: asking to get paid.

Here’s the thing—consultants often undercharge or create unprofessional invoices because they’re experts at strategy, not accounting. A polished consulting invoice changes the dynamic. It reinforces the value you delivered and makes payment feel like a natural next step, not an uncomfortable request.

Unlike product-based businesses, consulting work is intangible. Your clients can’t hold your advice in their hands. That makes your invoice critical—it’s the tangible artifact that represents your expertise.

Common consulting billing challenges:

| Service Type | Description | Typical Rate Range |

|---|---|---|

| Strategy Session | In-depth analysis and planning meeting | $150 - $500/hour |

| Market Research | Competitive analysis, market sizing | $1,000 - $5,000/project |

| Business Plan Development | Complete strategic planning document | $2,500 - $15,000/project |

| Advisory Retainer | Ongoing access for questions and guidance | $1,000 - $5,000/month |

| Implementation Support | Hands-on help executing recommendations | $125 - $350/hour |

| Training & Workshops | Group training sessions | $2,000 - $8,000/day |

| Executive Coaching | One-on-one leadership development | $200 - $800/session |

| Quarterly Business Review | Comprehensive progress assessment | $1,500 - $4,000/session |

Be Specific About Deliverables Instead of “Consulting Services - 10 hours @ $200,” try:

Clients pay faster when they clearly understand what they received.

Separate Phases for Large Projects For projects over $5,000, break billing into phases:

This reduces sticker shock and improves cash flow.

Include Your Payment Terms Clearly Standard consulting payment terms:

In the United States:

For Independent Consultants:

International Consulting:

Hourly + Project Hybrid Billing: Combine fixed-fee projects with hourly overflow for scope changes.

Retainer Tracking: Apply retainer hours against monthly invoices automatically.

Milestone Billing: Create invoices tied to specific project deliverables.

Time Entry Integration: Convert tracked work time directly into billable line items.

Multiple Rate Structures: Different rates for different service types (strategy vs. implementation).

Should I charge hourly or project-based fees? It depends on scope clarity. Use project fees when deliverables are well-defined (market research report, business plan). Use hourly for ongoing advisory work or when scope may evolve. Many consultants use a hybrid: project fee for core work, hourly for additional requests.

How do I handle scope creep in invoicing? Document your original scope clearly. When clients request additional work, send a brief email confirming the add-on and its cost before proceeding. Invoice add-ons as separate line items so the client sees the original project cost plus extensions.

What’s the best way to bill for a retainer? Invoice retainers at the beginning of each month. Clearly state unused hours do not roll over (if that’s your policy). Track hours against the retainer and provide a monthly summary showing hours used.

How do I invoice for travel time and expenses? State your travel policy upfront in your engagement letter. Common approaches: bill travel time at 50% of your hourly rate, or include a flat travel fee. Always itemize expenses separately (flights, hotels, meals) with receipts available upon request.

Should I require a deposit for new clients? Yes. For projects over $2,500, requiring a 50% deposit protects against non-payment and signals client commitment. For ongoing work, consider requiring first month payment upfront.

Ready to create consulting invoices that reflect your expertise? Download InvoiceZap and bill like the professional you are.

Join thousands of consulting using InvoiceZap

Create Your Consulting Invoice Now