Professional Cleaning Invoice Template - Free Download

Create professional cleaning invoices in 30 seconds. Download free templates or use our mobile app for instant PDF generation.

Create professional cleaning invoices in 30 seconds. Download free templates or use our mobile app for instant PDF generation.

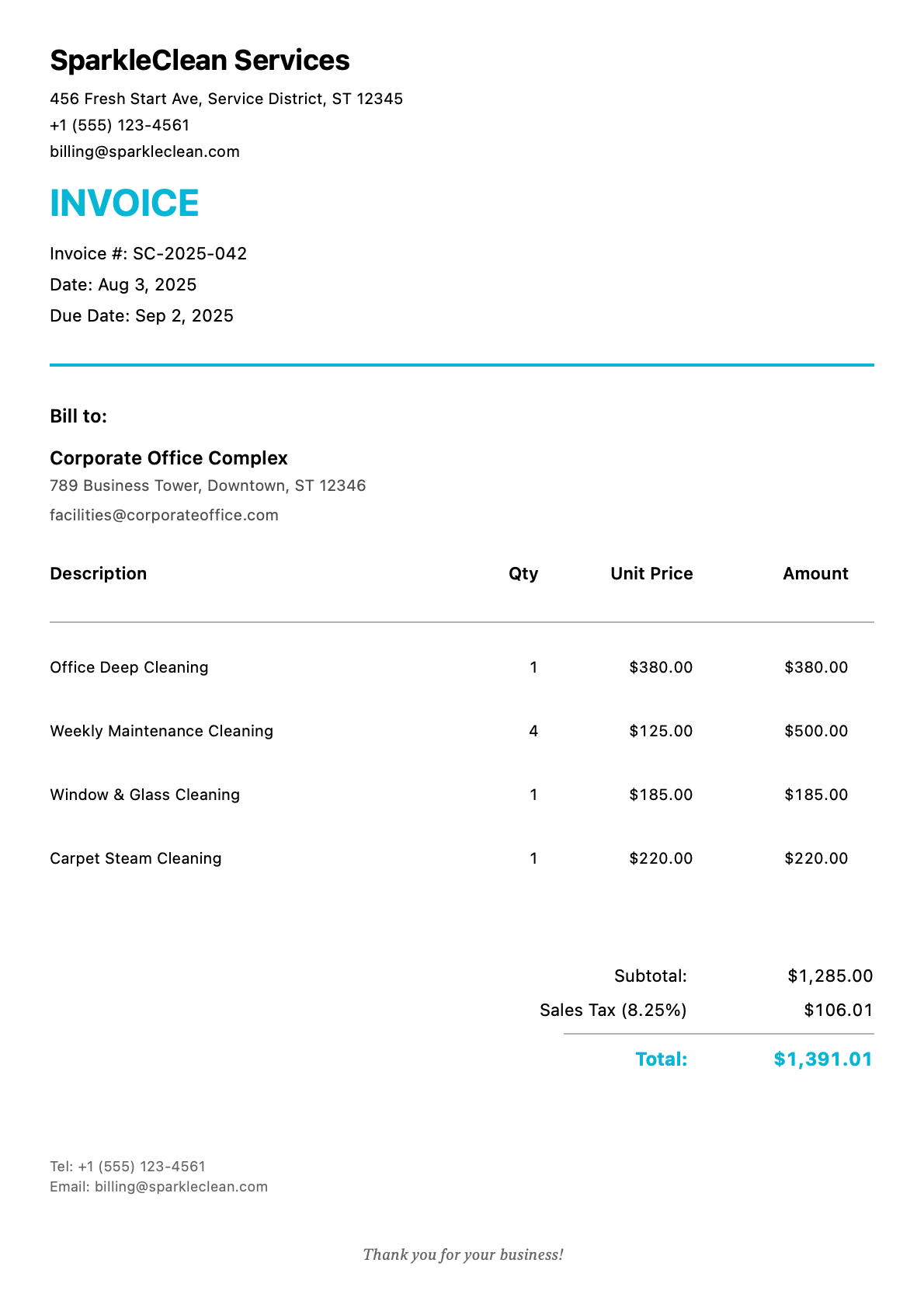

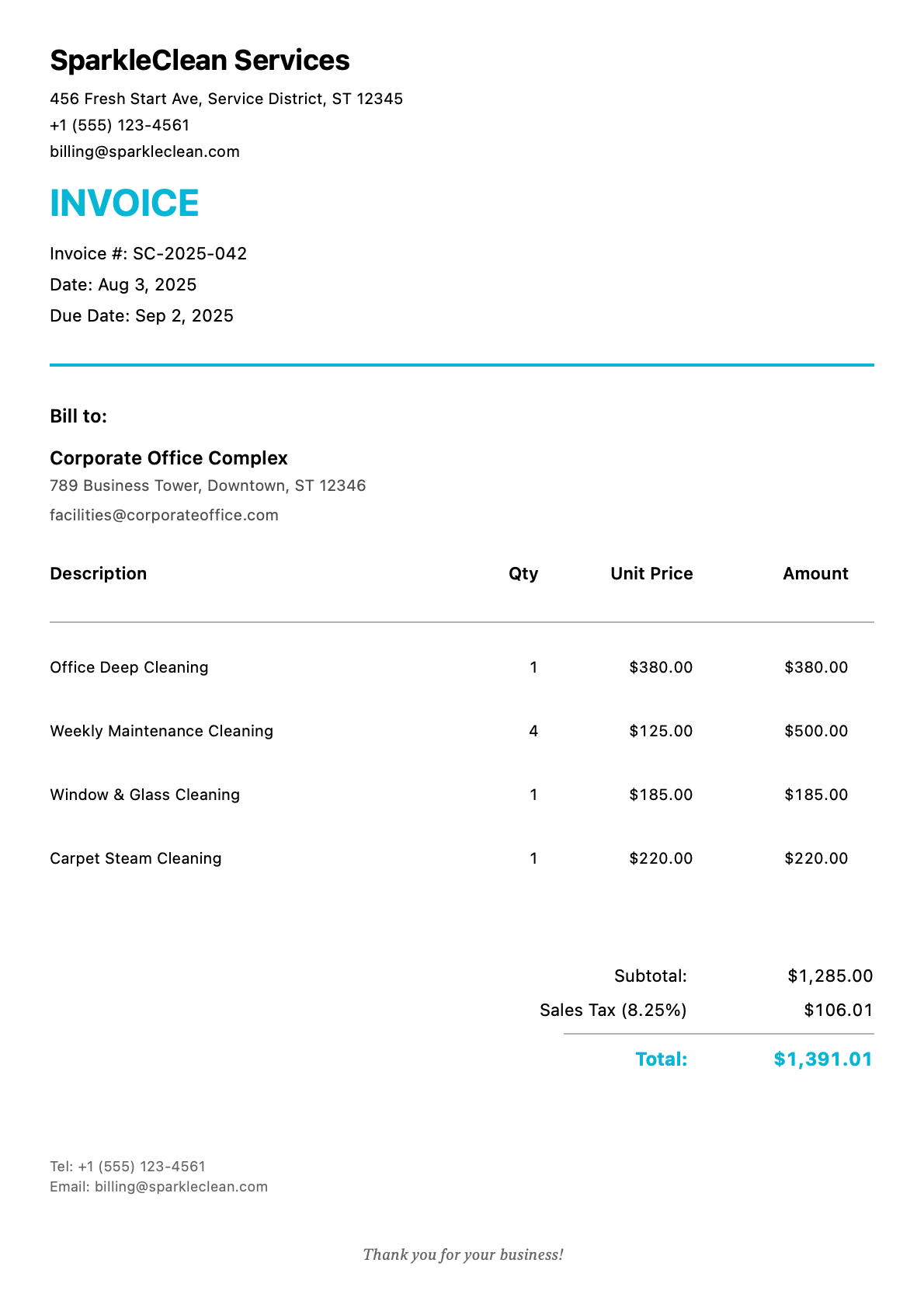

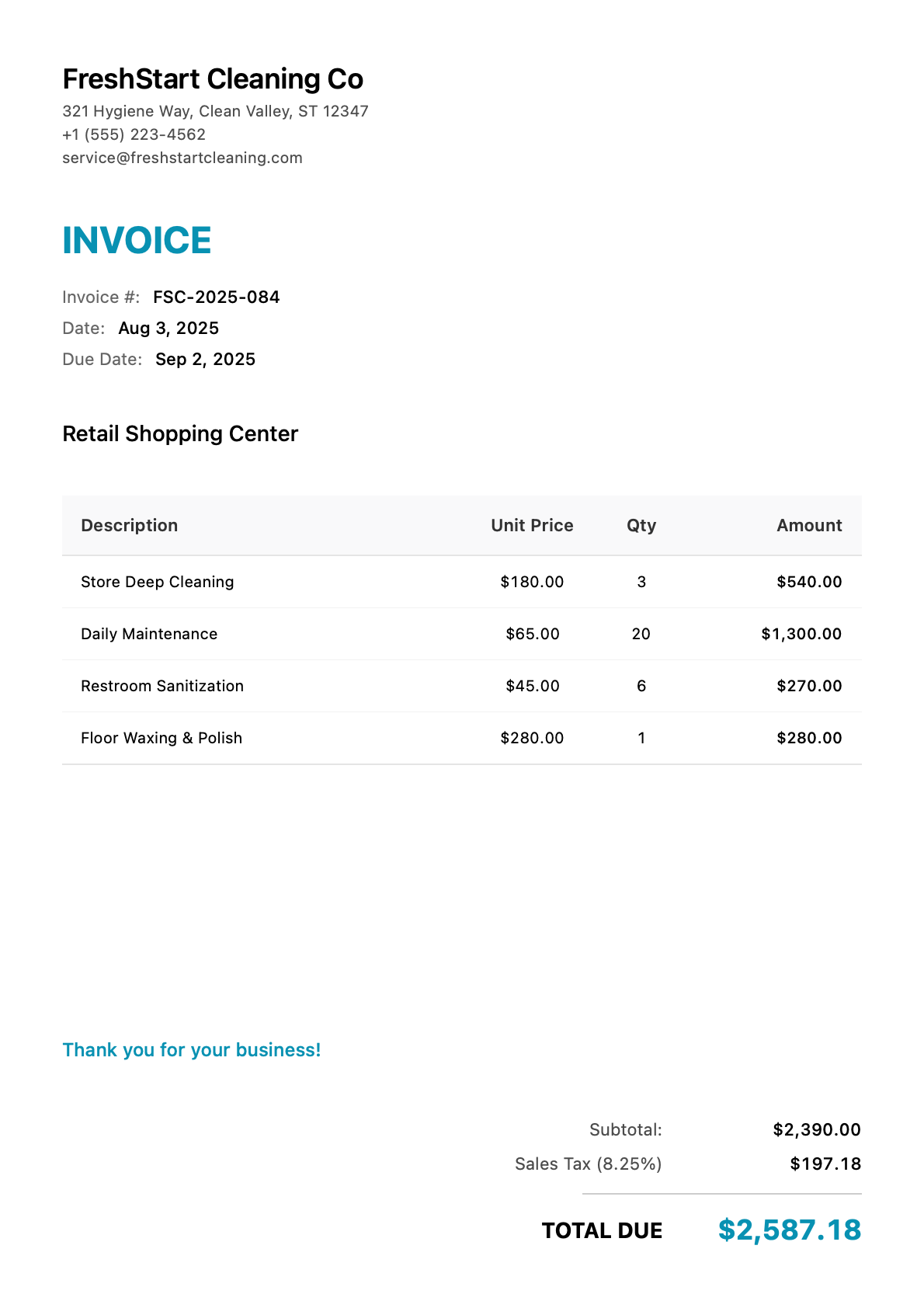

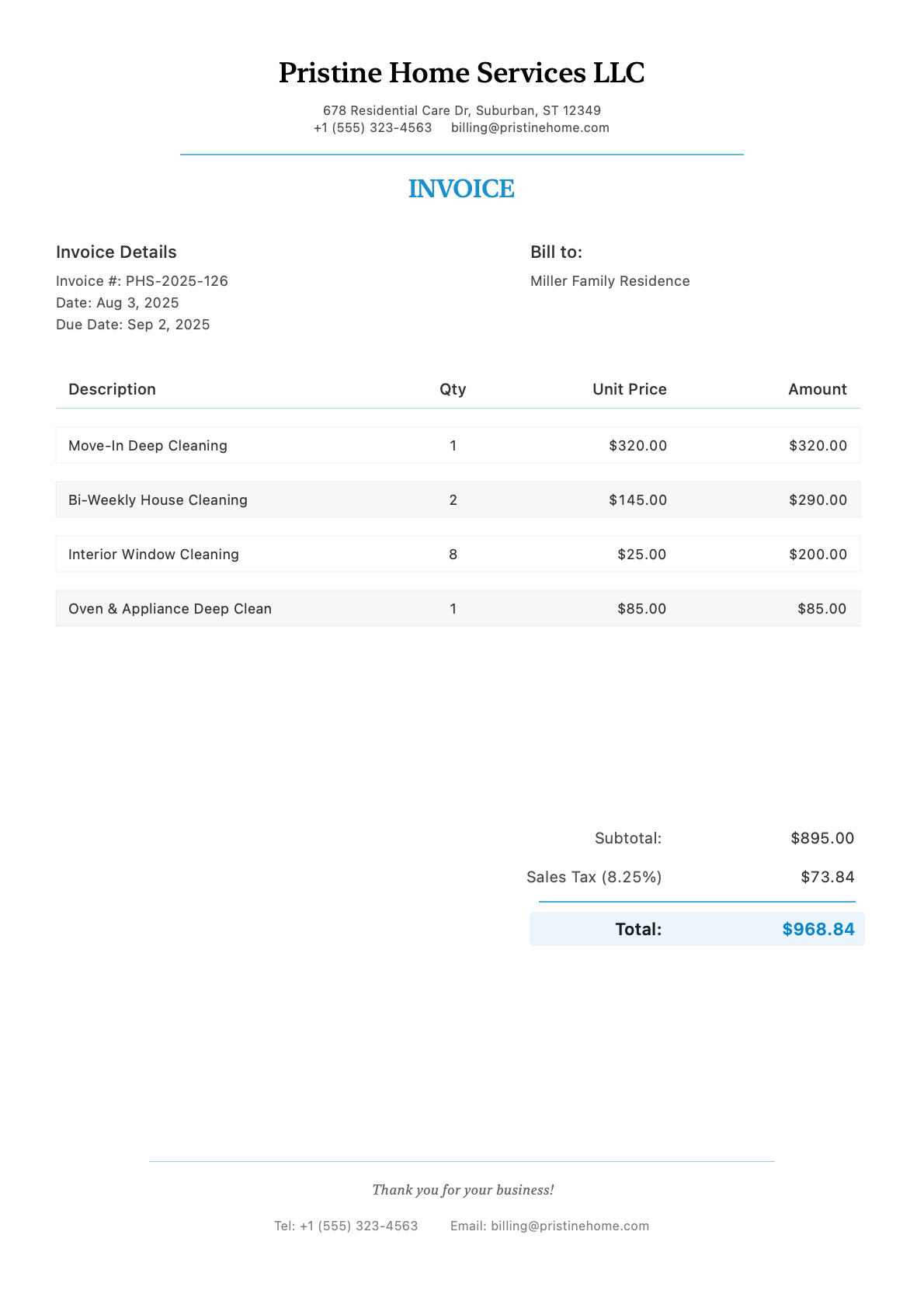

Professional invoice templates designed specifically for cleaning services. Each example uses realistic project details and industry-standard pricing.

Client: Miller Family Residence

Invoice #PHS-2025-126

Create Similar InvoiceCreate invoices on-site using your iPhone or iPad. No desktop required.

From project details to professional PDF in under 30 seconds.

Industry-specific templates with your branding and color scheme.

You finished a 3-hour deep clean. The house sparkles. The client is thrilled. Now you hand them a handwritten receipt on a scrap of paper and hope they pay promptly.

That’s the reality for too many cleaning professionals. Your work is spotless—your invoicing shouldn’t be an afterthought.

Cleaning is a trust-based business. Clients literally give you keys to their homes. A professional invoice reinforces that trust by showing you run a legitimate, organized operation.

Professional invoices help you:

| Service Type | Typical Services | Price Range |

|---|---|---|

| Residential Maintenance | Weekly/bi-weekly home cleaning | $100 - $200/visit |

| Residential Deep Clean | First-time or seasonal deep cleaning | $200 - $400 |

| Move-In/Move-Out | Complete property cleaning for moves | $250 - $500 |

| Commercial Office | Regular office/building cleaning | $0.05 - $0.20/sq ft |

| Commercial Retail | Store cleaning, restroom sanitization | $150 - $400/visit |

| Post-Construction | Debris removal, detail cleaning | 2-3x standard rate |

| Service | Description | Typical Price |

|---|---|---|

| Standard Maintenance Clean | Dust, vacuum, mop, bathrooms, kitchen | $25 - $40/hour |

| Deep Kitchen Cleaning | Appliances inside/out, cabinets, backsplash | $75 - $150 |

| Bathroom Deep Clean | Scrub, descale, sanitize, fixtures | $40 - $75/bathroom |

| Window Cleaning (Interior) | All accessible windows | $5 - $10/window |

| Carpet Shampooing | Deep clean with extraction | $0.25 - $0.50/sq ft |

| Inside Oven Cleaning | Heavy degreasing, rack cleaning | $30 - $50 |

| Inside Refrigerator | Shelves, drawers, sanitization | $25 - $40 |

| Baseboards & Trim | Detail dusting and wiping | $25 - $50 |

| Laundry Service | Wash, dry, fold (per load) | $20 - $35/load |

| Pet Hair Removal | Additional vacuuming, lint removal | $15 - $30 |

Good News for Most States: Cleaning services are generally not subject to sales tax in most US states because they’re considered personal services rather than tangible goods.

Tax-Free States for Cleaning Services: California, New York, Texas, Florida, Pennsylvania, Illinois, and most other states.

States That May Tax Cleaning: Hawaii, New Mexico, South Dakota, and West Virginia tax most services including cleaning.

Taxable vs. Non-Taxable:

| Generally Tax-Free | May Be Taxable |

|---|---|

| House cleaning services | Cleaning products sold to client |

| Office janitorial work | Tangible goods (trash bags, paper towels) |

| Window washing | Equipment rental |

| Carpet shampooing |

For Cleaning Business Owners:

Itemize by Room or Area Instead of “Cleaning Services - $150,” try:

Note Add-On Services Separately When you do extra work, show it:

This reminds clients of the extra value you provided.

Include Service Date and Duration

Documentation protects both you and the client.

Should I charge hourly or by the job for cleaning? Most residential cleaners use flat-rate pricing based on home size and service type. This gives clients predictable costs and rewards your efficiency. Hourly rates work better for commercial contracts or when scope is unpredictable (hoarding cleanup, post-construction).

How do I handle recurring cleaning clients? For weekly or bi-weekly clients, invoice after each visit or monthly (covering all visits). Monthly billing with a small discount (5-10%) for advance payment improves your cash flow and locks in the client.

What payment terms are standard for cleaning? Residential: Due upon completion (same-day payment). Commercial: NET 15 or NET 30. For new residential clients, consider requiring payment before you leave.

Should I include photos with my cleaning invoice? Before/after photos are valuable for deep cleans, move-out cleanings, and first-time clients. They justify premium pricing and reduce disputes. Include 2-3 key comparison shots for high-value jobs.

How do I bill for supplies I provide? Most cleaners include basic supplies in their rate. If clients request premium products (eco-friendly, specific brands), itemize those separately: “Eco-Friendly Products (client request): $15.”

Want the complete guide to cleaning business invoicing? Read our in-depth Cleaning Service Invoice Template & Billing Guide for pricing strategies, common mistakes, and detailed template examples.

Ready to create professional cleaning invoices? Download InvoiceZap and invoice on-site in 30 seconds.

Join thousands of cleaning using InvoiceZap

Create Your Cleaning Invoice Now