Professional Accounting Invoice Template - Free Download

Create professional accounting invoices in 30 seconds. Download free templates or use our mobile app for instant PDF generation.

Create professional accounting invoices in 30 seconds. Download free templates or use our mobile app for instant PDF generation.

Professional invoice templates designed specifically for accounting services. Each example uses realistic project details and industry-standard pricing.

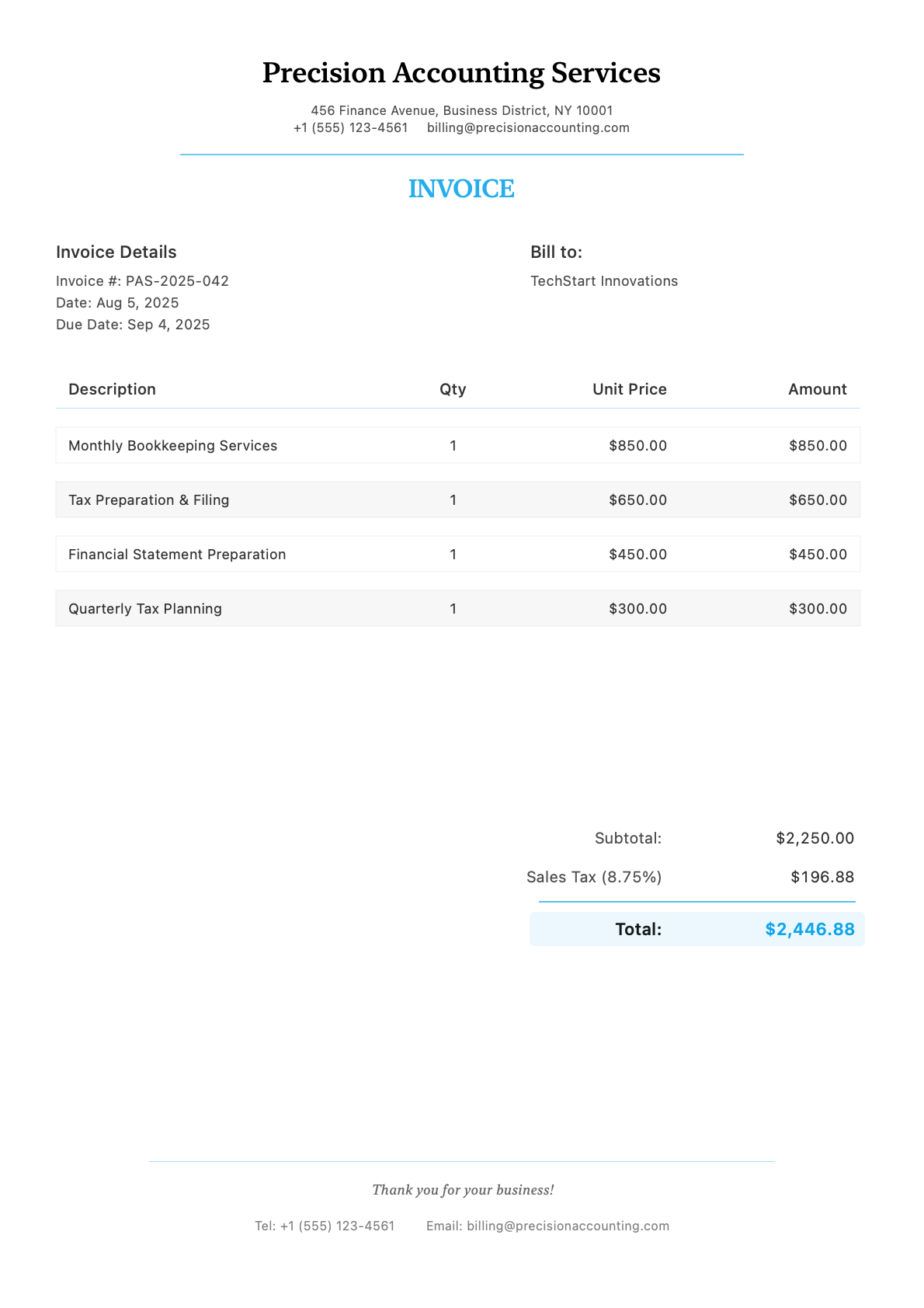

Client: TechStart Innovations

Invoice #PAS-2025-042

Create Similar Invoice

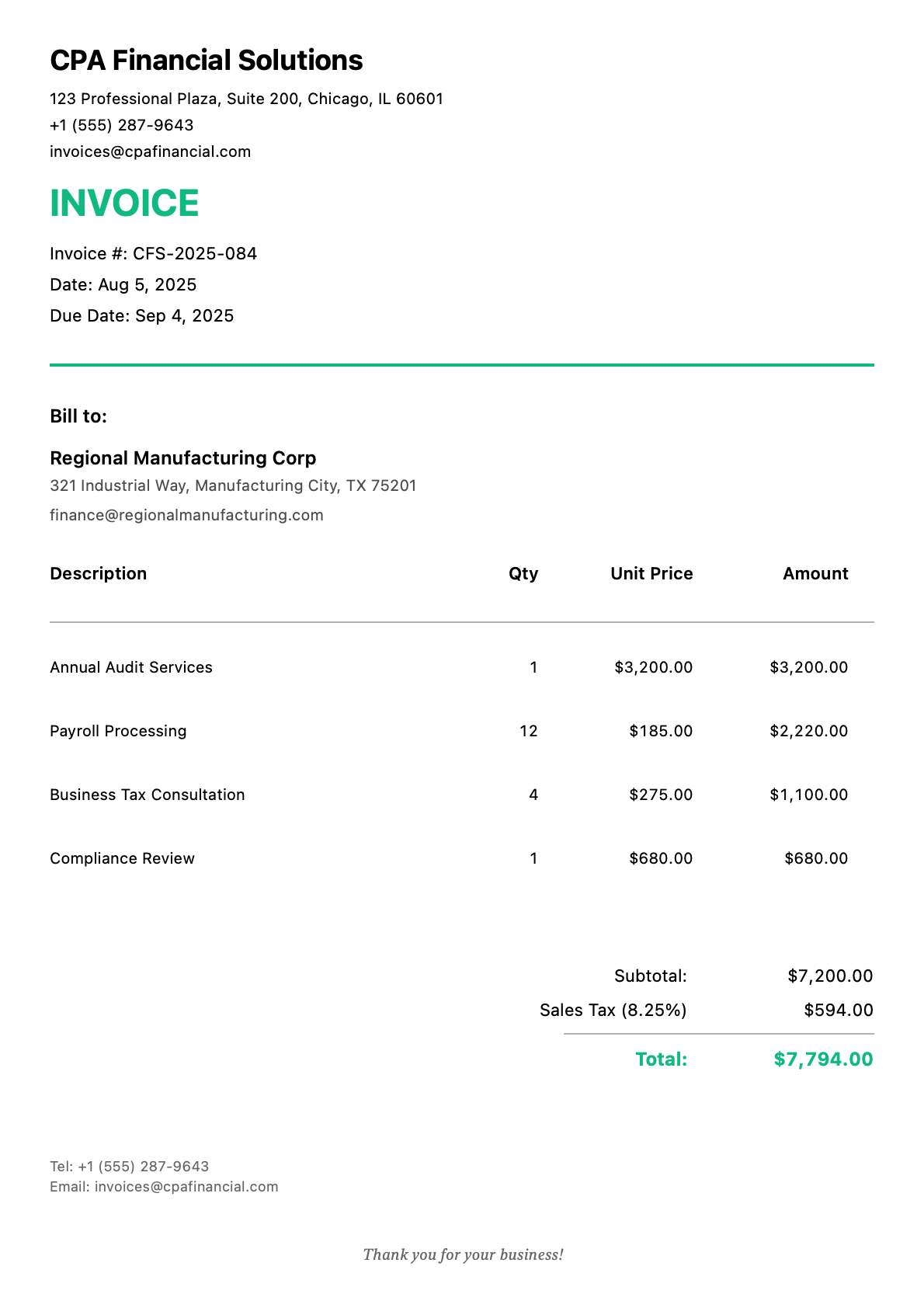

Client: Regional Manufacturing Corp

Invoice #CFS-2025-084

Create Similar Invoice

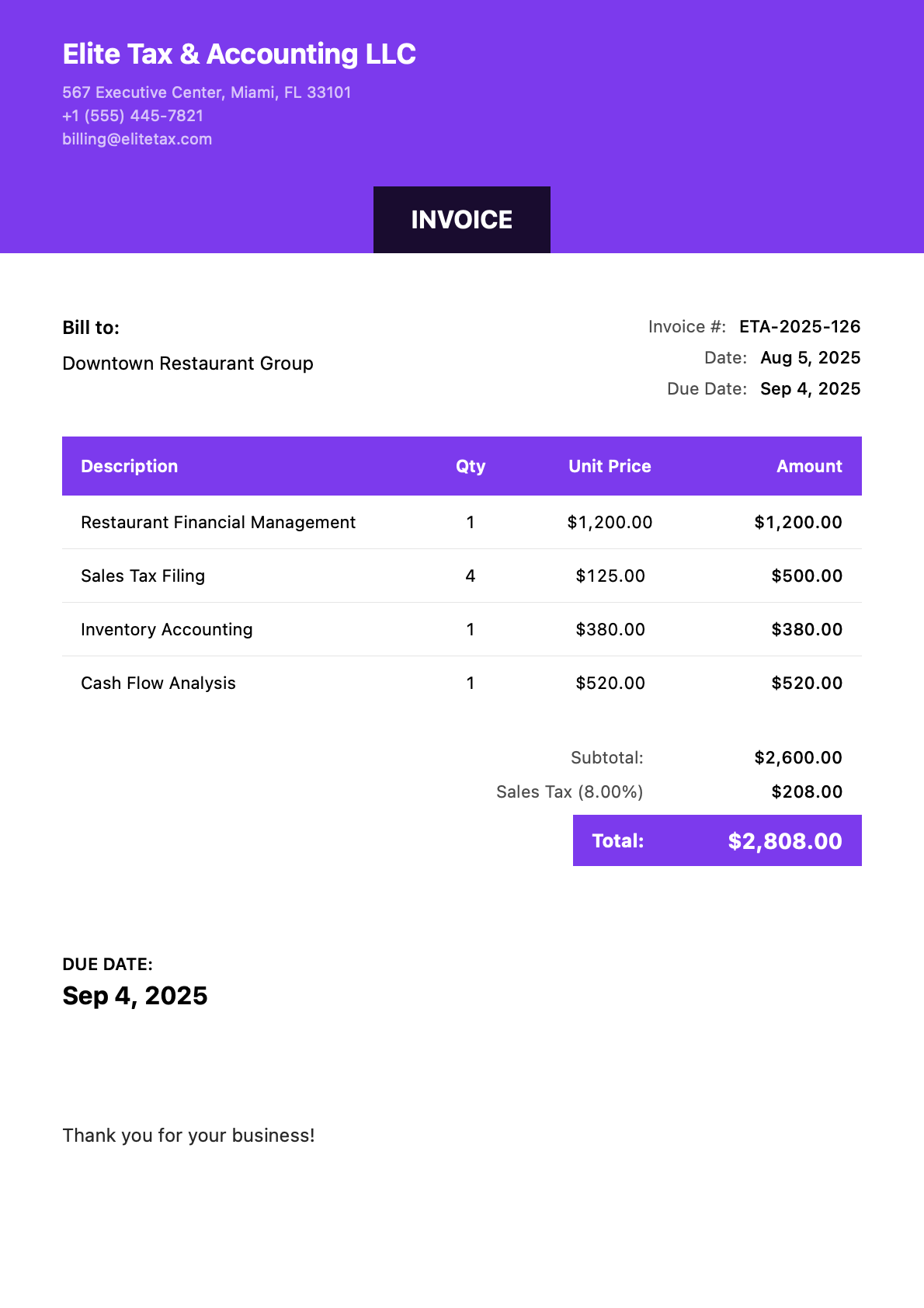

Client: Downtown Restaurant Group

Invoice #ETA-2025-126

Create Similar InvoiceCreate invoices on-site using your iPhone or iPad. No desktop required.

From project details to professional PDF in under 30 seconds.

Industry-specific templates with your branding and color scheme.

Get paid faster with professional accounting invoices created in under 30 seconds. Whether you’re billing for tax preparation, monthly bookkeeping, financial statement preparation, or advisory services, InvoiceZap’s accounting-specific templates include the line items and engagement structures that CPAs, accountants, and bookkeepers rely on.

Bill Immediately After Completing Work: Finish a client’s quarterly review? Invoice from your iPad before leaving their office. No more delayed billing cycles eating into your cash flow.

Engagement-Based Templates: Structure invoices for fixed-fee engagements, hourly billing, or monthly retainers—all on the same professional format.

Professional Credibility: Your invoice is a reflection of your attention to detail. A polished, well-organized invoice reinforces the precision clients expect from their accountant.

Client-Specific Tracking: Save client information for recurring invoices—monthly bookkeeping, quarterly tax payments, annual returns.

| Service Type | Description | Typical Rate Range | Unit |

|---|---|---|---|

| Tax Return Preparation (1040) | Individual federal tax return | $200 - $500 | Per Return |

| Tax Return Preparation (1120/1120S) | Corporate/S-Corp returns | $500 - $2,500 | Per Return |

| Tax Return Preparation (1065) | Partnership returns | $500 - $2,000 | Per Return |

| Monthly Bookkeeping | Transaction categorization, reconciliation | $200 - $800 | Per Month |

| Payroll Processing | Payroll calculation, filings, W-2s | $50 - $200 | Per Pay Period |

| Financial Statement Preparation | Balance sheet, P&L, cash flow | $250 - $750 | Per Statement Set |

| QuickBooks Setup & Training | Software setup, chart of accounts | $500 - $1,500 | Per Engagement |

| Audit & Review Services | CPA review or audit | $2,000 - $15,000+ | Per Engagement |

| Tax Planning & Advisory | Strategic tax planning | $150 - $400 | Per Hour |

| IRS Representation | Audit defense, collections | $200 - $500 | Per Hour |

Rates vary significantly by location, firm size, and client complexity. CPA firms typically command 20-40% higher rates than non-credentialed bookkeepers.

Fixed-Fee Engagements: Quote a set price for defined services (e.g., “Annual tax preparation: $350”). Clients appreciate price certainty. Best for routine work with predictable scope.

Hourly Billing: Bill at your standard hourly rate. Essential for advisory work, complex returns, or when scope is uncertain. Track time carefully and provide detailed descriptions.

Monthly Retainers: Offer bundled services for a fixed monthly fee (e.g., “$500/month for bookkeeping, bank reconciliation, and monthly financial statements”). Provides predictable income and strengthens client relationships.

Value-Based Pricing: For high-impact work like tax savings strategies or business restructuring, price based on value delivered rather than time spent.

For CPAs:

For All Accountants:

Should I bill hourly or fixed-fee for tax returns? Fixed-fee is preferred by most clients and simplifies your billing. Base your fee on return complexity (W-2 only vs. Schedule C, rentals, K-1s, etc.). Use hourly billing for unusual situations or first-time clients where scope is uncertain.

What payment terms are standard for accounting services? NET 15 or NET 30 is common. Many CPAs require payment before delivering final tax returns (especially e-filed returns). For large engagements like audits, bill in stages: planning, fieldwork, completion.

How do I invoice for monthly bookkeeping retainers? Create a recurring invoice on the same day each month. Include a brief summary of work performed (transactions processed, accounts reconciled) even though it’s a fixed fee. This demonstrates ongoing value.

Should I charge for client questions and phone calls? For hourly clients, yes—bill in 6-minute increments. For fixed-fee or retainer clients, include reasonable support in your fee. Document when calls exceed reasonable scope to justify additional billing.

How do I handle rush fees during tax season? Add a separate line item for “Rush Preparation Fee” or “Priority Processing.” Common rates: 25-50% premium for returns needed within 48-72 hours. Document the request date and delivery deadline.

Engagement Tracking: Reference engagement letters and link invoices to specific service agreements.

Credential Display: Prominently show CPA license, PTIN, and other professional designations.

Period Specification: Clearly note the fiscal period or tax year covered by each invoice.

Retainer Management: Track retainer balances and show how hours or services were applied.

Multi-Client Billing: Efficiently generate invoices for your full client roster.

Ready to streamline your accounting practice billing? Download InvoiceZap and create your first professional accounting invoice today.

InvoiceZap - Professional invoicing made simple for CPAs, accountants, and bookkeeping professionals.

Join thousands of accounting using InvoiceZap

Create Your Accounting Invoice Now