When your construction crew finishes a job, your client sees the quality workmanship, the attention to detail, and the professional result they paid for. Your invoice should reflect that same level of professionalism.

Unfortunately, most contractors still bill with basic templates that don’t capture the complexity of construction work—missing labor hours, material markups, permit costs, and the dozen other line items that separate professional contractors from weekend warriors.

Here’s how to create construction invoices that match the quality of your work and ensure you get paid fairly for every aspect of your project.

What Makes Construction Invoicing Different

Industry-Specific Billing Challenges

Construction invoicing isn’t like billing for simple services. Your projects involve:

Complex Cost Structures:

- Labor by trade specialty (electrical, plumbing, framing)

- Material costs with markup percentages

- Equipment rental and tool usage

- Subcontractor coordination fees

- Permit and inspection costs

Variable Timeline Billing:

- Progress payments by completion milestones

- Time and materials tracking

- Change order documentation

- Retention percentage holds

Compliance Requirements:

- Lien rights documentation

- Licensed contractor identification

- Insurance certificate references

- Safety compliance certifications

Your invoice template needs to handle this complexity while remaining clear enough for clients to understand exactly what they’re paying for.

The Professional Advantage

When clients receive detailed, well-organized construction invoices, they:

- Pay 34% faster on average than with basic billing

- Request fewer clarifications about charges and costs

- Refer contractors at 2.5x the rate of those with poor billing

- Accept change orders more readily when costs are clearly documented

Professional invoicing isn’t just about getting paid—it’s about positioning your construction business as trustworthy and detail-oriented.

Complete Construction Invoice Template

Here’s a comprehensive construction invoice template that demonstrates professional billing practices for contractors:

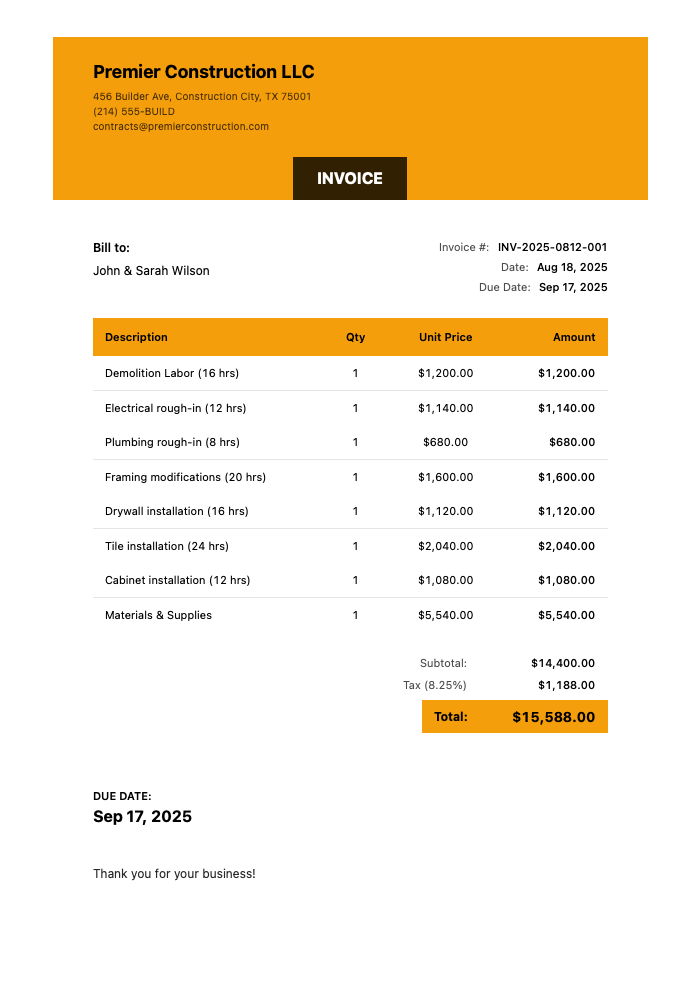

Click to view full size

This invoice template showcases the essential elements needed for construction project billing:

Professional Header:

- Company branding and logo placement

- Business license information display

- Complete contact information

- Project identification details

Detailed Cost Breakdown:

- Labor costs with hourly breakdowns

- Materials and supplies itemization

- Equipment rental charges

- Permits and inspection fees

- Clear subtotals for each category

Project Management Elements:

- Invoice numbering system (INV-2025-0812-001)

- Project timeline tracking

- Progress payment references

- Professional payment terms

Legal Protection:

- Lien rights notification

- Warranty information

- Payment terms and conditions

- Multiple payment method options

Key Financial Summary:

- $14,400+ in labor and materials

- Professional tax calculations

- Clear balance due presentation

- Progress payment tracking

This template ensures you capture all project costs while maintaining the professional appearance that builds client trust and supports prompt payment.

Industry-Specific Invoicing Best Practices

1. Progress Billing Structure

For larger construction projects, break invoicing into logical phases:

Foundation Phase (25% of project):

- Site preparation and excavation

- Foundation and concrete work

- Initial inspections

Framing Phase (30% of project):

- Structural framing

- Roofing installation

- Rough electrical and plumbing

Finishing Phase (35% of project):

- Insulation and drywall

- Finish electrical and plumbing

- Flooring and interior work

Final Phase (10% of project):

- Final inspections

- Touch-up and completion

- Cleanup and walkthrough

2. Change Order Documentation

Track and bill changes separately:

CHANGE ORDER #001 - August 3, 2025

Client Request: Add under-cabinet lighting

Additional Materials: ........................ $240.00

Additional Labor (4 hours @ $95/hr): ........ $380.00

Change Order Total: .......................... $620.00

Client Approval: [Signature] Date: 8/3/25

3. Material Markup Transparency

Be clear about material pricing:

Option A - Detailed Markup:

Materials at Cost: ........................... $4,200.00

Material Markup (20%): ....................... $840.00

Material Handling & Delivery: ................ $150.00

Total Materials: ............................. $5,190.00

Option B - Inclusive Pricing:

Materials (including markup & delivery): ..... $5,190.00

*Markup covers procurement, delivery, storage, and warranty

4. Subcontractor Integration

When working with subcontractors:

SUBCONTRACTED WORK

• HVAC Installation (ABC Heating): ........... $2,400.00

• Electrical Panel Upgrade (XYZ Electric): ... $1,200.00

*Direct payments to subcontractors arranged

*Coordination and supervision included in labor rates

Common Construction Invoice Mistakes

1. Vague Labor Descriptions

❌ Wrong: “Labor - $3,000”

✅ Right: “Tile installation - 24 hours @ $85/hr including prep, layout, cutting, and grouting”

2. Missing Permit Documentation

❌ Wrong: Permit costs buried in miscellaneous charges

✅ Right: Separate line item with permit numbers and inspection dates

3. Unclear Material Pricing

❌ Wrong: “Materials - $2,500”

✅ Right: Itemized materials with quantities and unit costs when possible

4. No Progress Payment Tracking

❌ Wrong: Each invoice starts from zero

✅ Right: Show running total, previous payments, and remaining balance

Legal & Compliance Considerations

Lien Rights Protection

Include lien rights language appropriate for your state:

NOTICE: Under [State] law, contractors and suppliers have

lien rights on property for unpaid work. This invoice

serves as formal notice of such rights.

License Display Requirements

Most states require license number display:

[Company Name] - Licensed General Contractor

State License #: [NUMBER] - Expires: [DATE]

Bonded and Insured - Bond #: [NUMBER]

Retention Clause Handling

For commercial projects with retention:

CONTRACT TOTAL: .............................. $50,000.00

COMPLETED TO DATE: ........................... $40,000.00

RETENTION HELD (10%): ........................ ($4,000.00)

AMOUNT DUE THIS INVOICE: ..................... $36,000.00

Digital Invoicing for Construction

Mobile-First Advantages

Modern construction requires mobile invoicing capabilities:

On-Site Benefits:

- Create invoices immediately after project milestones

- Photo documentation of completed work

- Client approval and signatures on-site

- Instant delivery while quality is visible

Time Management:

- No end-of-week office billing sessions

- Faster payment cycles through immediate invoicing

- Reduced administrative overhead

Tools like InvoiceZap make construction invoicing efficient by offering:

- Industry-specific templates with all necessary fields

- Photo integration for work documentation

- Manual payment tracking for progress billing

- Professional formatting that reflects work quality

Documentation Integration

Before Photos: Include with initial invoices to show starting conditions

Progress Photos: Document major milestones for progress billing

Completion Photos: Show finished quality for final invoices

Material Photos: Document specialty materials for cost justification

Automating Your Construction Billing

Template Setup Strategy

Create Project-Type Templates:

- Residential renovation template

- Commercial build-out template

- Repair and maintenance template

- Emergency service template

Standard Pricing Libraries:

- Common labor rates by trade

- Standard material costs with markup

- Equipment usage rates

- Permit and inspection fee schedules

Client Communication Workflow

Pre-Project:

- Written estimate with payment schedule

- Contract signing with billing terms

- Progress payment milestone definition

During Project:

- Weekly progress updates with photos

- Change order approvals before work

- Milestone completion confirmations

Post-Project:

- Final walkthrough documentation

- Warranty information delivery

- Follow-up for additional work opportunities

Getting Paid Faster

Payment Term Optimization

Standard Terms for Construction:

- Small projects (<$5K): Due upon completion

- Medium projects ($5K-$25K): Net 15 days

- Large projects (>$25K): Progress billing with Net 30

Incentive Structures:

- 2% discount for payment within 10 days

- 3% discount for full payment before project start

- Early payment bonus for repeat customers

Follow-Up System

Professional Collection Approach:

- Day 35: Friendly payment reminder

- Day 45: Formal past due notice

- Day 60: Final notice before lien filing

- Day 75: Lien filing and collection action

Construction-Specific Invoice Elements

AIA Forms Integration

Many commercial projects require AIA (American Institute of Architects) standard forms:

AIA G702 - Application for Payment:

- Project information and payment details

- Original contract amount and modifications

- Work completed to date calculations

- Retention amounts and current payment due

AIA G703 - Continuation Sheet:

- Detailed breakdown by work category

- Scheduled values for each trade

- Percentage completion tracking

- Previous and current billing amounts

For residential projects, simplified versions capture the same information without formal AIA formatting.

Prevailing Wage Documentation

For public works projects requiring prevailing wage:

LABOR - PREVAILING WAGE RATES

Journey-Level Carpenter (40 hours @ $65.50/hr): ... $2,620.00

Apprentice Electrician (32 hours @ $52.40/hr): .... $1,676.80

Equipment Operator (24 hours @ $58.30/hr): ........ $1,399.20

Laborer (60 hours @ $45.20/hr): ................... $2,712.00

Prevailing Wage Fringes: .......................... $1,240.00

Total Prevailing Wage Labor: ...................... $9,648.00

Davis-Bacon Act Compliance

Federal construction projects must comply with Davis-Bacon wage requirements. Your invoice should:

- Separate labor by classification (carpenter, electrician, laborer)

- Show hourly rates meeting or exceeding prevailing wage schedules

- Include fringe benefit calculations

- Reference certified payroll documentation

Retainage Management

Most commercial and public projects require retainage (typically 5-10%):

CONTRACT AMOUNT: ...................................... $125,000.00

WORK COMPLETED THIS PERIOD: ........................... $35,000.00

RETAINAGE (10%): ...................................... ($3,500.00)

PREVIOUS PAYMENTS: .................................... ($50,000.00)

CURRENT AMOUNT DUE: ................................... $31,500.00

RETAINAGE SUMMARY:

Total Retained to Date: ............................... $8,500.00

Retainage Release Date: ............................... Upon Final Completion

Specialty Construction Invoicing

Remodeling and Renovation Projects

Remodeling requires careful documentation of scope changes:

Discovery Items:

- Unexpected conditions found during demolition

- Code violations requiring correction

- Hidden structural issues

- Asbestos or lead paint remediation

Invoice Format:

ORIGINAL SCOPE ITEMS

Kitchen demolition: ................................... $1,200.00

Electrical rough-in: .................................. $2,400.00

DISCOVERY ITEMS (Client Approved 8/15/25)

Code violation correction - outdated wiring: .......... $800.00

Water damage repair - subfloor replacement: ........... $650.00

New Construction Invoicing

New builds have different billing requirements:

Site Work and Foundation:

- Permit costs (building, electrical, plumbing, mechanical)

- Survey and engineering fees

- Site preparation and excavation

- Foundation and concrete work

- Temporary utilities and porta-potty rental

Shell Construction:

- Framing materials and labor by area (walls, roof, decks)

- Exterior finish (siding, trim, windows, doors)

- Roofing materials and installation

- Rough mechanicals (HVAC, electrical, plumbing)

Finish Work:

- Insulation and drywall throughout

- Interior trim and doors

- Finish mechanicals and fixtures

- Flooring installation

- Cabinet and countertop installation

- Final cleanup and walkthrough

Commercial Construction

Commercial projects require additional invoice elements:

Prevailing Wage Certification:

- Certified payroll references

- Wage rate compliance documentation

- Apprentice ratios and journeyman hours

Performance Bond References:

- Bond information and coverage amounts

- Payment bond details for supplier protection

- Performance bond claim procedures

Lien Waiver Management:

- Conditional waivers with invoice

- Unconditional waivers upon payment

- Subcontractor lien waivers collected

Frequently Asked Questions About Construction Invoicing

What’s the standard payment schedule for construction projects?

Most construction contracts use a 3-4 payment milestone structure: (1) Deposit: 10-20% before starting, (2) Foundation completion: 25-30%, (3) Framing and rough-ins: 25-30%, (4) Substantial completion: 20-25%, and (5) Final payment: 10% after final inspection and punch list. Total project value determines whether you use 3, 4, or 5 payment milestones. Projects under $10K might use just two payments: 50% deposit and 50% on completion.

How do I handle change orders and billing for unexpected work?

Stop work immediately when you discover unexpected conditions. Document with photos, explain the issue to the client, and provide a written change order with cost estimate before proceeding. Get client signature approving the change order before continuing work. On your invoice, separate change orders from original scope items with clear section headers: “Original Contract Work” and “Approved Change Orders” with dates and approval references. This protects you legally and ensures payment for extra work.

Should I include a materials markup on construction invoices?

Yes, material markup (typically 10-20%) is industry standard and covers your time procuring materials, delivery costs, storage, waste allowance, and warranty responsibilities. You can present this as either: (1) Transparent markup: “Materials at cost: $5,000, Markup (15%): $750” or (2) Bundled pricing: “Materials including procurement and delivery: $5,750.” Residential clients often prefer bundled pricing while commercial clients expect transparent markup disclosure. Never sell materials at cost—you’re providing expertise, procurement, and logistics value.

What information do I legally need on construction invoices?

Requirements vary by state, but typically include: (1) Your business name and contractor license number, (2) Business address and contact information, (3) Project address and client name, (4) Detailed description of work performed, (5) Labor and material breakdown, (6) Total amount due and payment terms, (7) Lien rights notice (required in most states), (8) Insurance and bond information for commercial work. Check your state’s contractor licensing board for specific requirements, as missing required information can jeopardize lien rights or license compliance.

How do I bill for permits and inspection fees on construction projects?

Bill permits and inspections as separate line items at actual cost (no markup on government fees): “Building Permit #2025-1234: $485.00, Electrical Permit #2025-E567: $125.00, Final Inspection Fee: $75.00.” Include permit numbers and approval dates for documentation. For projects requiring multiple inspections, consider adding a “Permitting Coordination Fee” (typically $200-500) to cover time spent at permit office, scheduling inspections, and managing approval process. Clients understand that permits are required costs and appreciate transparent billing.

What’s the difference between retainage and retention in construction billing?

Retainage (or retention) refers to the same concept: a percentage of each payment (typically 5-10%) withheld by the client until project completion. On each invoice, show: “Work Completed: $20,000, Less Retainage (10%): -$2,000, Amount Due: $18,000.” Track cumulative retainage: “Total Retained to Date: $8,500.” Retainage protects clients against defective work or contractor non-completion, and is released after final inspection, punch list completion, and lien waiver submission. Some states limit retainage percentages or require release timelines.

How should I invoice for subcontractor work?

You have two options: (1) Direct billing: Subcontractors bill client directly, you coordinate but don’t mark up, or (2) Prime contractor billing: You invoice client for all work including subs, adding 10-20% coordination fee. Most general contractors use option 2: “HVAC Installation - $4,500 (Subcontracted to ABC Heating).” Your markup covers subcontractor management, supervision, schedule coordination, and warranty responsibility. Always collect lien waivers from subs before releasing their payment to protect yourself from liens.

When should I send the final invoice on a construction project?

Send the final invoice immediately after: (1) Passing final inspection, (2) Completing all punch list items, (3) Obtaining occupancy permit (if required), and (4) Conducting final walkthrough with client. Include on your final invoice: “All work completed per contract dated [DATE], Final inspection passed [DATE], Punch list items completed [DATE].” Don’t delay final invoicing—clients may request additional “while you’re here” work that muddles the completion date and delays payment.

How do I handle billing when material costs increase mid-project?

Your contract should include price escalation clauses for projects over 90 days: “Material costs subject to adjustment for price increases beyond contractor’s control.” When lumber, steel, or other materials increase significantly, provide updated pricing to client immediately with documentation of increases (supplier price sheets). Options: (1) Client approves additional cost before continuing, (2) You eat the increase as a goodwill gesture (small amounts), or (3) You split the increase 50/50 with client. Document everything in writing and get approval before proceeding.

What should I do if a client refuses to pay a construction invoice?

Construction law gives you powerful tools. First, send formal demand letter via certified mail. Second, if payment isn’t received within 30 days of invoice due date, file a preliminary notice (or mechanic’s lien notice, depending on your state). Third, if still unpaid after 60-90 days, file the actual mechanic’s lien against the property. The lien process varies by state but generally prevents property sale until you’re paid. Consider consulting a construction attorney for liens over $10K. Many clients pay immediately once they understand lien implications. See our guide on what to do when clients don’t pay for detailed recovery strategies.

Conclusion: Professional Billing for Professional Work

Your construction invoices are often the last impression clients have of your work quality. Make sure they reflect the same attention to detail and professionalism that goes into your building projects.

Professional construction invoicing includes:

- Detailed labor breakdowns by trade and timeline

- Transparent material costs with appropriate markup

- Permit and compliance documentation

- Clear payment terms and lien rights notices

- Progress billing for larger projects

Ready to streamline your construction billing? Download InvoiceZap and access construction-specific templates that handle complex project billing in 30 seconds. Join thousands of contractors who’ve upgraded to professional mobile invoicing.

Your clients trust you to build their projects right the first time. Make sure your invoicing reflects that same level of professionalism and attention to detail.

Related Resources

Ready to Streamline Your Invoicing?

Create professional invoices in 30 seconds with InvoiceZap's mobile-first design. No sign-up required.

Try InvoiceZap FreeTags: