Landing your first international client feels amazing—until you sit down to create the invoice and realize you have no idea what information is legally required, how to handle taxes, or whether you should charge in USD, EUR, or GBP.

Here’s the reality: 34% of international payments are delayed or rejected due to incorrect invoicing—often for simple mistakes like missing VAT numbers or wrong currency formatting.

Whether you’re a US freelancer working with European clients, a UK consultant serving American companies, or an EU service provider with global reach, this guide will walk you through everything you need to know about international invoicing in 2025.

The Stakes: Why International Invoicing Matters

Getting international invoicing wrong isn’t just inconvenient—it’s expensive:

Financial Impact of Invoice Mistakes

- Average payment delay: 14-21 days for corrected invoices

- Rejection rate: 12% of international invoices require corrections

- Currency loss: Poor exchange rate timing can cost 3-5% of invoice value

- Compliance penalties: Can range from warnings to significant fines

Opportunity Cost

- Time spent correcting invoices instead of serving clients

- Delayed cash flow affecting business operations

- Potential loss of repeat international business

- Stress and confusion around international regulations

The good news? Most international invoicing challenges have straightforward solutions once you understand the requirements.

Understanding International Invoice Requirements

Universal Requirements (All Countries)

Before diving into country-specific rules, these elements are essential for any international invoice:

Essential Information:

- Your complete business name and address

- Client’s complete business name and address

- Unique invoice number with consistent formatting

- Invoice date and payment due date

- Clear description of services or products

- Amounts in specified currency

- Payment terms and methods

- Your business registration/tax numbers

Professional Standards:

- Consistent branding and formatting

- Clear, professional language

- Multiple currency options when appropriate

- Digital delivery with PDF backup

Country-Specific Requirements

United States (Invoicing TO US Clients)

Required Information:

- Your business name and complete address

- Client’s business name and complete address

- Invoice number and date

- Description of services/products

- Total amount due

- Payment terms

Tax Considerations:

- US clients don’t require you to collect US sales tax (this is their responsibility)

- Your home country taxes still apply to your income

- Form 1099 reporting: US clients may need your Tax ID or SSN for their records

- Backup withholding: Some US clients may withhold 24% if you don’t provide proper tax information

Best Practices for US Clients:

Invoice Format Example:

Invoice #2025-001

Date: January 15, 2025

From: [Your Business]

[Your Address]

Tax ID: [Your Country's Tax ID]

To: [US Client Company]

[US Address]

Services: Website Design Project

Amount: $5,000 USD

Terms: Net 30

Payment Methods:

- ACH Transfer (US bank details)

- Wire Transfer (SWIFT details)

- PayPal/Stripe

United Kingdom (Invoicing TO UK Clients)

Required Information:

- Your business name and address

- Client’s business name and address

- Invoice number and date

- Description of services/products

- Amount excluding VAT

- VAT amount (if applicable)

- Total amount including VAT

- Payment terms

VAT Considerations:

- UK VAT registration threshold: £90,000 annually (as of 2025)

- Reverse charge mechanism: For B2B services, UK client pays VAT, not you

- VAT number requirement: Must include client’s UK VAT number for B2B services

- Zero-rated services: Many digital/professional services are zero-rated for non-UK providers

Brexit Impact:

- EU providers: Now treated as non-EU for VAT purposes

- Different rules for goods vs. services

- Place of supply rules determine where VAT applies

UK Invoice Example:

Invoice #2025-001

Date: 15 January 2025

From: [Your Business]

[Your Address]

VAT Number: [If applicable]

To: [UK Client Company]

[UK Address]

VAT Number: GB123456789

Services: Marketing Consultation

Net Amount: £2,000.00

VAT (20%): £0.00 (Reverse Charge)

Total Due: £2,000.00

Note: VAT to be accounted for by the customer under the reverse charge mechanism.

European Union (Invoicing TO EU Clients)

Required Information:

- Your business name and address

- Client’s business name and address

- Invoice number and date

- Your VAT number (if applicable)

- Client’s VAT number

- Description of services/products

- Unit prices and quantities

- VAT rate and amount

- Total amount

- Currency

EU VAT Rules (2025):

- B2B services: Generally subject to reverse charge (client pays VAT)

- B2C services: You may need to register for VAT in client’s country

- Digital services: Special rules under MOSS (Mini One Stop Shop)

- Threshold varies: Each EU country has different registration thresholds

Cross-Border Service Rules:

- Place of supply: Usually where the client is established

- Evidence requirements: Must prove where client is located

- Record keeping: Detailed records required for EU VAT compliance

EU Invoice Example:

Invoice #2025-001

Date: 15/01/2025

From: [Your Business]

[Your Address]

VAT: [Your VAT Number]

To: [EU Client Company]

[EU Address]

VAT: DE123456789

Services: Software Development

Net Amount: €3,000.00

VAT: €0.00 (Art. 196 VAT Directive - Reverse Charge)

Total Due: €3,000.00

Reverse Charge: Customer liable for VAT

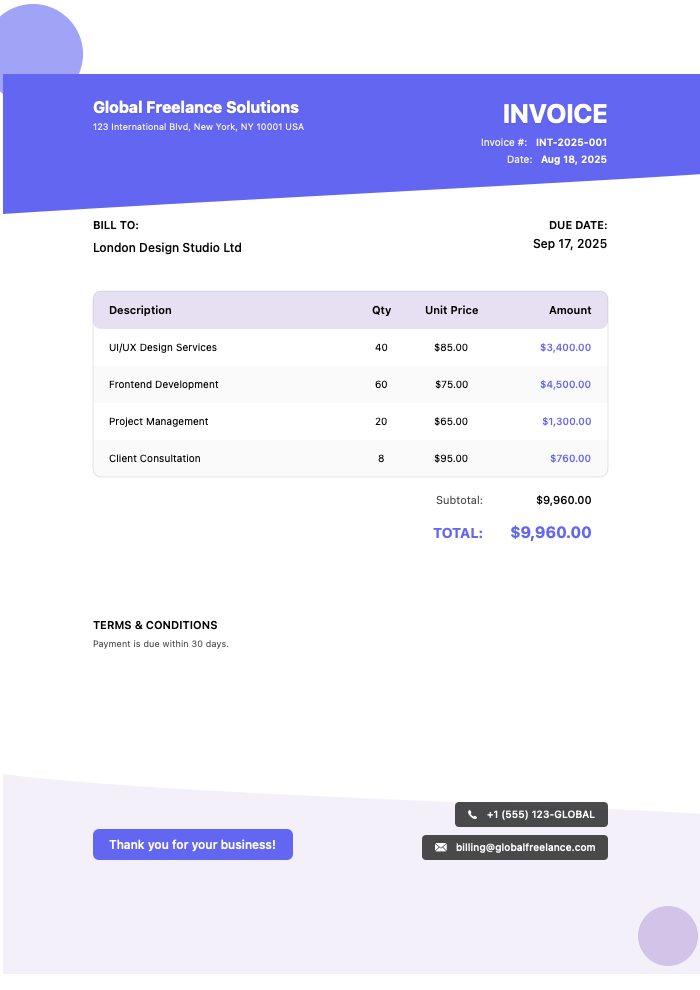

Professional International Invoice Example

Here’s how a comprehensive international invoice looks when properly formatted for cross-border business:

Click to view full size

This international invoice demonstrates key elements for professional cross-border billing:

Global Business Presentation:

- Professional international business branding

- Clear cross-border service identification

- Multi-currency transaction handling

- International payment method options

Compliance Elements:

- Proper legal entity information

- VAT/tax identification numbers

- Cross-border service classification

- International payment terms

Service Documentation:

- UI/UX design services breakdown

- Frontend development itemization

- Project management tracking

- Client consultation documentation

Professional Communication:

- Clear currency designation (USD)

- International payment instructions

- Professional service descriptions

- Executive-level presentation quality

This template ensures your international clients receive invoices that meet professional standards while demonstrating your expertise in global business practices.

Currency and Payment Considerations

Choosing the Right Currency

Factors to Consider:

- Client preference: What’s easier for them to process?

- Your bank fees: Which currency minimizes your costs?

- Exchange rate stability: Volatile currencies add risk

- Payment processor fees: Different fees for different currencies

Common Strategies:

- Invoice in client’s local currency - Easier for them, you bear exchange risk

- Invoice in your local currency - Easier for you, client bears exchange risk

- Invoice in major currency (USD/EUR) - Neutral option, both parties familiar

Managing Exchange Rate Risk

Fixed Rate Strategy:

- Quote and invoice in same currency

- Lock in exchange rates at quote time

- Use forward contracts for large projects

- Build exchange rate buffers into pricing

Dynamic Rate Strategy:

- Use real-time exchange rates

- Invoice in strongest currency at the time

- Accept exchange rate fluctuations as business cost

- Focus on currency diversification

International Payment Methods

Bank Wire Transfers:

- ✅ Secure and reliable

- ✅ Good for large amounts

- ❌ Slow (2-5 business days)

- ❌ High fees ($25-50+ each direction)

Digital Payment Platforms:

- ✅ Fast and convenient

- ✅ Better exchange rates than banks

- ✅ Lower fees than wire transfers

- ❌ May have country restrictions

Cryptocurrency (Where Legal):

- ✅ Very fast transfers

- ✅ Low fees for large amounts

- ❌ Regulatory uncertainty

- ❌ High volatility risk

InvoiceZap integrates with multiple payment processors to give your international clients the payment options they prefer, while automatically handling currency conversion and compliance documentation.

Tax Compliance and Record Keeping

Documentation Requirements

Essential Records:

- All invoices sent and payments received

- Client location verification (address, VAT numbers)

- Exchange rates used for accounting

- Tax registration certificates

- Communication showing place of service delivery

Retention Periods:

- US: 3-7 years depending on circumstance

- UK: 6 years for most business records

- EU: Varies by country, typically 5-10 years

Working with Tax Professionals

When to Consult an Expert:

- Annual international income exceeds $50,000

- Working with multiple countries regularly

- Unsure about VAT registration requirements

- Receiving conflicting advice about tax obligations

Questions to Ask Your Accountant:

- Do I need to register for VAT in client countries?

- How should I report foreign income?

- What exchange rates should I use for accounting?

- Are there any tax treaties that benefit me?

- What records do I need to maintain?

Common Mistakes and How to Avoid Them

Mistake #1: Wrong VAT Treatment

Problem: Charging VAT when reverse charge should apply Solution: Verify B2B vs B2C rules for each country Check: Include client’s VAT number and reverse charge language

Mistake #2: Currency Confusion

Problem: Mixing currencies within single invoice Solution: Choose one currency per invoice and stick to it Check: Ensure all amounts, including taxes, use same currency

Mistake #3: Missing Required Information

Problem: Forgetting country-specific requirements Solution: Create country-specific invoice templates Check: Compare against official government requirements

Mistake #4: Poor Exchange Rate Management

Problem: Using outdated or inconsistent exchange rates Solution: Use real-time rates or fix rates at quote time Check: Document exchange rate source and date

Mistake #5: Inadequate Record Keeping

Problem: Missing documentation for tax compliance Solution: Systematic filing and backup of all international transactions Check: Regular record keeping audits

Best Practices for International Invoicing

Template Strategy

Create specific templates for each major market:

US Client Template:

- USD currency

- Clear tax information disclaimer

- Multiple payment options

- US date format (MM/DD/YYYY)

UK Client Template:

- GBP currency

- VAT reverse charge language

- UK date format (DD/MM/YYYY)

- UK-style address formatting

EU Client Template:

- Local currency option

- VAT directive references

- EU date format (DD/MM/YYYY)

- Multi-language payment terms

Communication Strategy

Before Starting Work:

- Confirm invoicing currency and payment terms

- Verify client’s VAT number and address

- Discuss payment methods and timing

- Clarify any tax withholding requirements

With Each Invoice:

- Include clear payment instructions

- Provide multiple payment options

- Offer support for any questions

- Follow up professionally if payment is delayed

Technology Solutions

Invoice Automation:

- Use software that handles multiple currencies

- Integrate with international payment processors

- Automate VAT calculations and reverse charge language

- Track payments and send reminders automatically

Compliance Tracking:

- Monitor changing regulations

- Set up alerts for new requirements

- Maintain digital records with backup

- Use accounting software with international features

The Future of International Invoicing

Regulatory Trends

- Digital tax reporting: More countries requiring electronic submissions

- Real-time VAT reporting: Some EU countries implementing immediate VAT reporting

- Cryptocurrency regulation: Clearer rules emerging for crypto payments

- Simplified procedures: Cross-border trade becoming more standardized

Technology Developments

- AI-powered compliance: Automatic detection of invoicing requirements

- Blockchain verification: Tamper-proof international transaction records

- Real-time currency conversion: Instant, accurate exchange rate application

- Integrated tax filing: Direct connection between invoicing and tax systems

Getting Started: Your 30-Day Action Plan

Week 1: Assessment and Setup

- Identify your international clients and their countries

- Research specific requirements for each country

- Choose your currency strategy for each market

- Include appropriate payment instructions for international transfers

Week 2: Template Creation

- Create country-specific invoice templates with required information

- Add appropriate VAT and tax language for each jurisdiction

- Test templates with sample information

- Get feedback from existing international clients

Week 3: System Implementation

- Include international payment instructions clearly

- Configure accounting software for multiple currencies

- Create compliance documentation system

- Establish record-keeping procedures

Week 4: Launch and Monitor

- Send first invoices using new international templates

- Track payment times and any questions from clients

- Document any issues and solutions

- Schedule regular compliance reviews

Tools and Resources

Government Resources

- US: IRS.gov for US tax requirements

- UK: HMRC.gov.uk for UK VAT and tax rules

- EU: ec.europa.eu for VAT directive information

Practical Tools

- Exchange rates: xe.com, oanda.com for current rates

- VAT validation: EU VAT validation service for number verification

- Country guides: Government trade websites for specific requirements

Professional Support

- International tax advisors: For complex multi-country situations

- Trade associations: Industry-specific guidance

- Legal counsel: For contract and compliance questions

Making International Invoicing Simple

International invoicing doesn’t have to be complicated. The key is understanding that each country has specific requirements, but they’re all logical and manageable once you know what they are.

The three pillars of successful international invoicing:

- Know the rules - Research requirements once, apply them consistently

- Use the right tools - Technology that handles complexity automatically

- Keep good records - Systematic documentation prevents problems

InvoiceZap takes the complexity out of international invoicing by automatically formatting invoices according to country requirements, handling multi-currency calculations, and maintaining the documentation you need for tax compliance.

Ready to simplify your international invoicing? Download InvoiceZap and get access to country-specific templates, automatic VAT calculations, and clear international payment instructions. Turn international complexity into competitive advantage.

Working with clients in countries not covered here? InvoiceZap’s template system adapts to any country’s requirements. Download the app and access our growing library of international invoice templates, backed by automatic compliance updates.

Ready to Streamline Your Invoicing?

Create professional invoices in 30 seconds with InvoiceZap's mobile-first design. No sign-up required.

Try InvoiceZap FreeTags: