You just finished a balayage that took three hours, and your client loves it. She asks for the total, and you’re… calculating in your head? Writing on a sticky note?

That’s leaving money on the table—literally. Clients forget add-on services. They don’t remember they added that deep conditioning treatment. And when you’re tallying mentally, you undersell yourself.

Professional invoicing isn’t just about looking legitimate. It’s about capturing every dollar you’ve earned and building a client record that helps you remember their preferences, color formulas, and service history.

This guide breaks down exactly what belongs on a hair stylist invoice, with templates you can use immediately.

What Makes Salon Invoices Different

Hair styling invoices aren’t like other service invoices. You’re dealing with:

Multiple service types in one appointment:

- Base services (cut, color, style)

- Add-on treatments (conditioning, toner)

- Product sales (take-home care)

- Gratuity (which may or may not appear on the invoice)

Variable pricing based on factors like:

- Hair length and thickness

- Color complexity (single process vs. full balayage)

- Stylist experience level

- Time required

Recurring client relationships:

- Clients return every 4-8 weeks

- They expect consistency in pricing

- Service history matters for color matching

Essential Invoice Elements for Hair Stylists

Header Information

Your business details:

[Your Name] or [Salon Name]

Professional Hair Stylist

123 Beauty Ave, Suite 5

City, State ZIP

Phone: (555) 123-4567

Email: stylist@email.com

License #: [Your cosmetology license number]

Why include your license? It signals professionalism and is required in some states for certain billing situations. Clients paying through FSA/HSA or corporate accounts may need it.

Client Information

At minimum:

- Client name

- Phone number or email

- Service date

For regular clients, consider tracking:

- Color formulas used (note in description)

- Preferred products

- Appointment preferences

Service Line Items

Here’s where salon invoices get specific. Break down every service:

Cutting Services:

| Service | Description | Price |

|---|---|---|

| Women’s Haircut | Consultation, cut, style | $65 |

| Men’s Haircut | Clipper or scissor cut | $35 |

| Bang Trim | Fringe maintenance | $15 |

| Children’s Cut | Ages 12 and under | $30 |

Color Services:

| Service | Description | Price |

|---|---|---|

| Single Process Color | Root to ends, one shade | $95 |

| Partial Highlights | Face frame and crown | $120 |

| Full Highlights | Full head foils | $175 |

| Balayage | Hand-painted highlights | $200+ |

| Color Correction | Per hour | $100/hr |

| Gloss/Toner | Shine enhancement | $45 |

Treatment Add-Ons:

| Service | Description | Price |

|---|---|---|

| Deep Conditioning | Intensive moisture treatment | $25 |

| Olaplex Treatment | Bond repair | $35 |

| Scalp Treatment | Detox and stimulation | $30 |

| Keratin Express | Smoothing treatment | $150 |

Product Sales

Track retail separately from services:

PRODUCTS

- Olaplex No. 3 Hair Perfector $30.00

- Color-Safe Shampoo (16 oz) $28.00

- Heat Protectant Spray $24.00

Product Subtotal: $82.00

Why separate products?

- Different sales tax treatment in some states

- Clearer for inventory tracking

- Some salons have different commission structures for retail vs. services

The Gratuity Question

This is where salon billing gets tricky. Options:

Option 1: Include gratuity line (suggested amount)

Service Total: $185.00

Suggested Gratuity (20%): $37.00

---

TOTAL: $222.00

Option 2: Leave gratuity off the invoice Many stylists prefer clients tip in cash separately, not documented on the invoice.

Option 3: For credit card payments

Subtotal: $185.00

Gratuity: $_____

TOTAL: $_____

What works best: If you’re a booth renter or independent stylist, leaving gratuity as a separate cash transaction is common. If you’re invoicing corporate clients (bridal parties, editorial work), include a service charge instead.

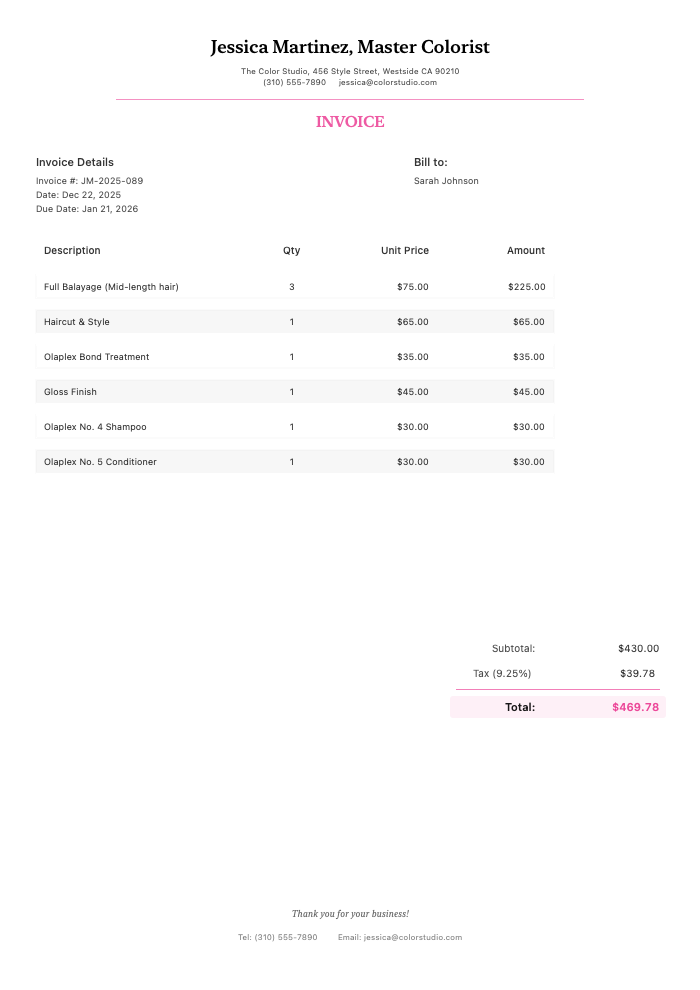

Sample Invoice: Full Color Appointment

Here’s a complete invoice example showing exactly how a professional salon invoice should look:

Click to view full size

This invoice demonstrates all the essential elements we discussed:

- Clear business information with cosmetology license number

- Itemized services showing each treatment separately

- Product sales tracked distinctly from service charges

- Professional formatting that matches salon quality

- Multiple payment options clearly listed

Next appointment recommended: 8-10 weeks for toner refresh

Booth Renter vs. Salon Employee Invoices

Your employment situation changes what goes on your invoice:

Booth Renters (Independent Contractors)

You invoice the client directly:

- Your own business name and information

- Your own payment methods

- You handle your own taxes and reporting

You may also invoice the salon:

- For any product sales processed through salon register

- Commission reconciliation (if applicable)

Salon Employees

The salon typically handles client invoices. However, you might still need invoices for:

- Freelance work (bridal, editorial)

- Private clients outside salon hours

- Education and training services

Commission Tracking

If you work on commission, your internal tracking should note:

Client: Sarah Johnson

Service Total: $370.00

My Commission (55%): $203.50

Product Commission (10%): $6.00

Tips Received: $74.00 (cash)

───────────────────────────

My Take-Home: $283.50

This isn’t for the client—it’s for your own records.

Special Situation Invoices

Bridal and Event Packages

Wedding work needs clear package pricing:

BRIDAL PACKAGE - WEDDING OF [Bride Name]

Date: March 15, 2026

Location: Rosewood Estate, Napa

Bride Services:

- Trial session (completed Nov 10) $150.00

- Wedding day styling (updo) $200.00

- Touch-up at ceremony Included

Bridal Party (4 bridesmaids @ $85 each) $340.00

Mother of Bride styling $95.00

Travel fee (Napa Valley) $100.00

───────────────────────────────────────────────────

PACKAGE TOTAL $885.00

Deposit Paid (Nov 10): $300.00

BALANCE DUE (Day of wedding): $585.00

Editorial and Commercial Work

For photoshoots and commercial work, invoice the production company:

INVOICE FOR STYLING SERVICES

Project: Spring Campaign Photoshoot

Client: [Agency/Brand Name]

Date: January 8, 2026

Location: Downtown Studio

Day Rate (8 hours) $500.00

Overtime (2 hours @ $75/hr) $150.00

Kit Fee $75.00

Parking $25.00

───────────────────────────────────────────────────

TOTAL $750.00

NET 30 - Payment due by February 7, 2026

Education and Training

If you teach other stylists:

ADVANCED BALAYAGE WORKSHOP

Instructor: [Your Name]

Venue: [Salon Name]

Date: February 20, 2026

Duration: 6 hours

Workshop Fee (12 attendees @ $200) $2,400.00

Materials provided Included

Certificate of completion Included

Travel reimbursement $150.00

───────────────────────────────────────────────────

TOTAL $2,550.00

Building Invoices in Under a Minute

Here’s the reality: Between clients, you have maybe 5 minutes. You’re washing out color, cleaning your station, and your next appointment is walking in.

The fast way: Invoice apps like InvoiceZap let you create client invoices in about 30 seconds. Set up your common services once, select client, tap services, send. Your client gets a professional PDF while you’re grabbing a coffee between appointments.

What saves the most time:

- Pre-saved service items (no re-typing “Full Balayage” every time)

- Saved client profiles (they’re already in your list)

- Quick duplicate for recurring clients with similar services

Tracking What Actually Matters

Beyond the invoice itself, smart stylists track:

For each client:

- Color formulas (brand, developer, placement)

- Processing times

- Before/after notes

- Product sensitivities

For your business:

- Average ticket per client

- Services by popularity

- Retail attachment rate

- Client retention (who came back, who didn’t)

Your invoicing system becomes your business intelligence. One year of organized invoices tells you which services make you the most money, which clients are your best, and where to focus your marketing.

Getting Paid: Best Practices for Stylists

At the chair: Most salon payments happen immediately, but for larger services (bridal, color corrections), consider:

- 50% deposit at booking

- Balance due at appointment

For delayed invoicing: Editorial work and training often require invoicing after the fact. Include:

- Net 15 or Net 30 payment terms

- Multiple payment options (make it easy)

- Your cancellation/late payment policy

For package deals: If you sell packages (e.g., “4 blowouts for the price of 3”), invoice the full amount upfront and track remaining credits in your system.

Show Off Your Work: Before/After Transformations

Color transformations are your best marketing. That brassy blonde becoming a perfect platinum, or the gray coverage that takes years off—these results speak louder than any ad.

Before/after photos drive bookings. Every stylist knows clients bring inspiration photos, but showing your own work builds trust faster. Use comparison photos in:

- Instagram posts and stories

- Consultation discussions (“Here’s a similar transformation I did”)

- Your portfolio and website

- Client text follow-ups (“Here’s your transformation!”)

Pro tip: Take a “before” photo in good lighting before starting any color service. After styling, capture from the same angle. Use Before After Photo Compare to create slider animations showing the transformation—clients can drag to see the exact change. These get way more engagement than side-by-side photos on social media.

The Takeaway

A professional invoice does more than get you paid—it:

- Captures every service and product accurately

- Creates a record for client color formulas and preferences

- Builds your financial history for tax time

- Makes you look like the professional you are

Ready to create salon invoices that take seconds, not minutes? InvoiceZap lets you build client profiles, save your services menu, and generate professional invoices on your iPhone between appointments. Start your 3-day trial and see how it works.

Ready to Streamline Your Invoicing?

Create professional invoices in 30 seconds with InvoiceZap's mobile-first design. No sign-up required.

Try InvoiceZap FreeTags: