“I’ll pay you in 30 days.”

Those six words can make or break a freelancer’s cash flow. But here’s what most freelancers don’t realize: invoice timing isn’t just about when you send the bill—it’s a strategic business practice that can cut your average payment time in half.

Research shows that 63% of payment delays aren’t about the client’s ability to pay—they’re about timing, psychology, and the little details that make invoices either urgent or forgettable.

The difference between waiting 45 days for payment and getting paid in 10 days often comes down to strategies you can implement starting with your very next invoice.

The Hidden Psychology of Payment Timing

Before diving into tactics, let’s understand why timing matters so much:

The Payment Priority Stack

Every business has limited attention for financial tasks. Your invoice competes with:

- Urgent operational expenses (rent, utilities, payroll)

- Vendor payments with established relationships

- Recurring subscriptions and automated payments

- Other freelancer invoices just like yours

Your goal: Move your invoice higher in this priority stack.

Cognitive Bias in Payment Decisions

- Recency bias: Recently received invoices get faster attention

- Urgency bias: Near-deadline items are prioritized

- Relationship bias: Known/liked vendors get paid first

- Convenience bias: Easy-to-process invoices are handled quickly

Strategy #1: Send Invoices on Tuesday or Wednesday

The Research: Payment processing data shows a clear pattern in when invoices get the fastest attention.

Payment Speed by Day Sent:

- Monday: 18.3 days average (overwhelmed with week startup)

- Tuesday: 12.7 days average ⭐

- Wednesday: 11.4 days average ⭐

- Thursday: 15.2 days average (end-of-week rush)

- Friday: 19.8 days average (forgotten over weekend)

Why Tuesday-Wednesday Works:

- Accounts payable teams are settled into their week

- Not competing with Monday morning emergencies

- Processed before end-of-week rush

- Higher chance of same-week payment approval

Implementation Tips:

- Set up automatic invoicing for Tuesday at 10 AM

- Batch your invoicing to send all weekly invoices on Tuesday

- Follow up on Wednesdays for any urgent payments needed

When you send invoices consistently on optimal days, clients begin to expect and plan for your payments, creating a reliable cash flow pattern.

Strategy #2: The 24-Hour Invoice Rule

The Rule: Send your invoice within 24 hours of completing work.

The Psychology: Fresh completion creates several psychological advantages:

- Work is top-of-mind for the client

- Value perception is highest immediately after delivery

- Momentum carries from project completion to payment

- Delays create forgetfulness and reduced urgency

Real-World Impact:

Case Study: Sarah, a freelance designer, tested this with 50 invoices:

- Before (7-day delay): Average payment time 28 days

- After (24-hour rule): Average payment time 16 days

- Result: 43% faster payments, improved cash flow by $3,200/month

Making It Practical:

- Prepare invoices during project completion

- Use mobile invoicing to send immediately after client meetings

- Set completion triggers that remind you to invoice

- Batch small tasks to reach invoicing minimums faster

The moment you deliver work should trigger your payment process, not next week when you “get around to invoicing.”

Strategy #3: Strategic Payment Terms (The 2/10 Net 30 Approach)

Traditional approach: “Net 30” (payment due in 30 days) Strategic approach: “2/10 Net 30” (2% discount if paid within 10 days, otherwise due in 30)

The Math That Makes It Work:

- 2% discount for 20-day acceleration = 36% annual return

- Most clients take the discount (saves them money, saves you time)

- Those who don’t still pay in 30 days (no loss vs. traditional terms)

Alternative Structures:

- 1/7 Net 21: 1% discount for 7-day payment

- 3/5 Net 15: 3% discount for 5-day payment (high-value projects)

- Net 15 + 1.5% monthly after: Firm terms with late penalties

Implementation Example:

Payment Terms: 2/10 Net 30

- Pay within 10 days: $4,900 (2% discount applied)

- Pay within 30 days: $5,000 (full amount)

- After 30 days: $5,000 + 1.5% monthly late fee

Results from 1,000+ freelancers using this strategy:

- 67% of clients take the early payment discount

- Average payment time reduced from 28 to 12 days

- Annual cash flow improvement of 15-20%

Strategy #4: The Progress Payment System

Instead of: One large invoice at project completion Try: Multiple smaller invoices throughout the project

Progressive Payment Structures:

For Project Work:

- 50% deposit before starting work

- 25% at midpoint milestone

- 25% at completion

For Ongoing Services:

- Weekly invoicing for regular clients

- Bi-weekly invoicing for medium projects

- Milestone invoicing for long-term work

Psychology Behind Smaller Invoices:

- Lower dollar amounts get approved faster

- Regular payment habit develops with client

- Cash flow smooths out over project timeline

- Late payment risk decreases (smaller amounts, more frequent)

Real Example:

Before: $10,000 invoice at project end, paid in 35 days After:

- $5,000 deposit (immediate)

- $2,500 at week 2 (paid in 8 days)

- $2,500 at completion (paid in 12 days)

Result: Same total payment, but 80% received 23 days earlier.

InvoiceZap makes progress payments simple with recurring invoice templates and scheduling reminders, so you can set up your payment structure once and track it efficiently.

Strategy #5: The Monday Morning Follow-Up System

The Strategy: Systematic follow-up that increases urgency without being pushy.

The 3-Touch Follow-Up Sequence:

Touch 1 (Invoice + 7 days): “Hi [Name], Hope you received the invoice for [project] sent last week. Let me know if you have any questions about the work or payment process. Thanks!”

Touch 2 (Invoice + 14 days): “Hi [Name], Following up on invoice #[number] for $[amount]. It’s due today - is there anything I can help with to process payment this week?”

Touch 3 (Invoice + 21 days): “Hi [Name], Invoice #[number] is now a week past due. I want to resolve this quickly - can we arrange payment by Friday? Happy to discuss if there are any issues.”

Follow-Up Best Practices:

- Always be helpful, not demanding

- Offer solutions, not just reminders

- Use phone calls for amounts over $2,000

- Document everything for your records

Automation Tools:

- Automatic email reminders at set intervals

- Payment status tracking in your invoicing system

- Template messages for consistent communication

- Calendar integration for follow-up scheduling

Strategy #6: The Relationship-Based Payment Priority

The Reality: Clients pay people they like faster than strangers.

Building Payment Priority Through Relationships:

- Remember personal details from conversations

- Ask about their business and challenges

- Offer helpful advice beyond your core service

- Be genuinely interested in their success

Practical Relationship Tactics:

During Projects:

- Weekly check-ins that go beyond project status

- Proactive problem-solving before issues arise

- Value-add suggestions that save them time/money

- Professional but personal communication style

Between Projects:

- Helpful article sharing relevant to their business

- Introduction facilitation to useful contacts

- Industry insight sharing from your other work

- Holiday and milestone acknowledgments

The Payment Priority Result:

Clients who consider you a trusted advisor rather than just a vendor pay 34% faster on average.

Strategy #7: The Technology Advantage (Mobile + Integration)

The Problem: Traditional invoicing creates friction in the payment process.

The Solution: Remove every possible barrier to payment.

Modern Payment Friction Reducers:

Mobile-Optimized Invoices:

- Responsive design that looks professional on phones

- One-click payment buttons for immediate action

- Auto-filled payment information when possible

- Multiple payment instructions (check, bank transfer, PayPal, Venmo)

Integration Advantages:

- Accounting software integration for client’s bookkeeping

- Calendar integration for payment reminders

- Clear instructions for payment methods

- CRM integration for relationship management

Real-World Technology Impact:

Traditional PDF Invoice:

- Client receives email

- Downloads PDF

- Files for later processing

- Remembers to process (maybe)

- Logs into payment system

- Enters payment details

- Processes payment

Mobile-First Invoice:

- Client receives notification

- Taps to view invoice

- Taps “Pay Now”

- Payment processed instantly

Result: Average payment time drops from 22 days to 6 days with mobile-optimized invoicing.

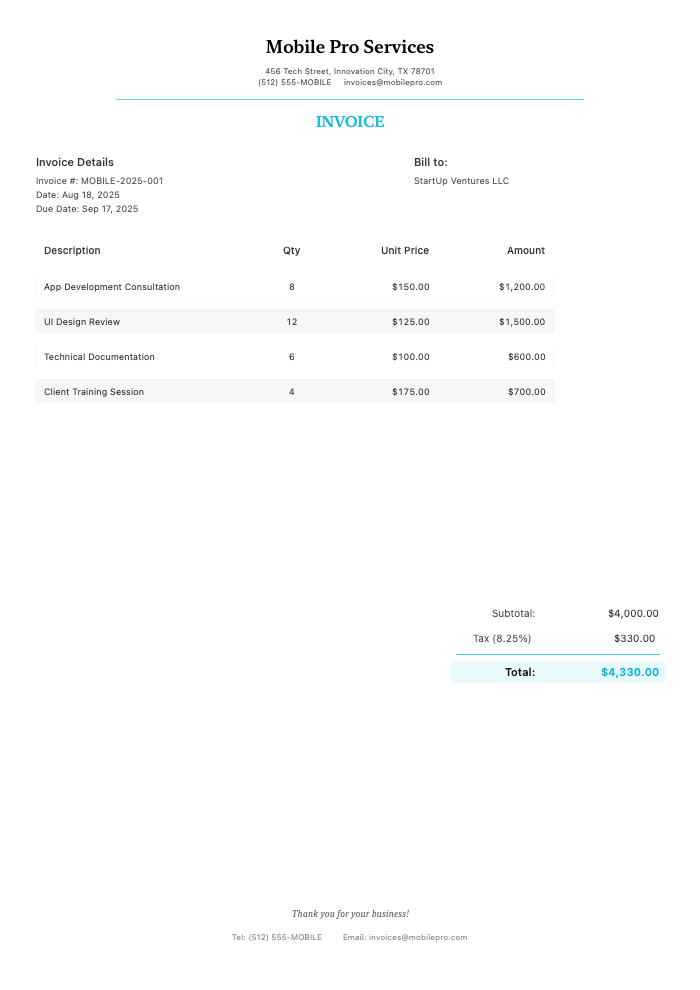

Mobile-Optimized Invoice Example

Here’s what a professional mobile-first invoice looks like in practice:

Click to view full size

This mobile-optimized invoice demonstrates key elements for faster payments:

Mobile-First Design:

- Clean, readable layout on any screen size

- Finger-friendly payment buttons

- Clear service descriptions and pricing

- Professional business presentation

Quick Payment Elements:

- Prominent total amount display

- Multiple payment method options

- One-click payment capability

- Clear payment instructions

Professional Communication:

- Timely invoice delivery

- Clear project identification

- Professional terms and conditions

- Contact information for questions

This template enables the streamlined payment process that reduces average payment time from weeks to days.

Putting It All Together: The Complete Timing Strategy

Your New Invoice Timing Workflow:

Project Completion (Day 0):

- ✅ Send invoice within 24 hours

- ✅ Send on Tuesday or Wednesday at 10 AM

- ✅ Include 2/10 Net 30 payment terms

- ✅ Use mobile-optimized invoice with one-click payment

Day 7:

- ✅ Friendly follow-up if no payment received

- ✅ Offer assistance with any questions

Day 14:

- ✅ Payment due reminder

- ✅ Include clear payment instructions

Day 21:

- ✅ Past due notice with phone call for large amounts

- ✅ Offer payment plan if needed

Expected Results:

- 40-60% reduction in average payment time

- 15-25% improvement in cash flow

- Stronger client relationships through professional follow-up

- Fewer payment disputes due to clear communication

Common Timing Mistakes to Avoid

Mistake #1: Inconsistent Invoicing Schedule

Problem: Clients can’t predict or plan for your invoices Solution: Set regular invoicing days and stick to them

Mistake #2: Waiting Until You Need the Money

Problem: Desperation shows in your communication Solution: Invoice immediately after work completion, regardless of your current cash position

Mistake #3: One-Size-Fits-All Payment Terms

Problem: Different clients have different payment capabilities Solution: Adjust terms based on client size and payment history

Mistake #4: Avoiding Follow-Up

Problem: Invoices get forgotten without reminders Solution: Systematic, professional follow-up is part of good business practice

Mistake #5: Complex Payment Processes

Problem: Friction reduces payment speed Solution: Make paying your invoice the easiest thing on their to-do list

The Long-Term Impact

Implementing these timing strategies doesn’t just improve individual invoice payments—it transforms your entire business:

Cash Flow Predictability

- Regular income cycles instead of feast-or-famine

- Better financial planning capability

- Reduced stress about money management

- Growth capital available when opportunities arise

Client Relationship Benefits

- Professional reputation for organized business practices

- Preferred vendor status due to clear communication

- Repeat business from satisfied clients

- Referrals from clients who appreciate your professionalism

Getting Started Today

Choose one strategy to implement immediately:

If you want the biggest impact: Start the 24-hour invoice rule If you want the easiest win: Switch to Tuesday invoicing If you want long-term improvement: Implement 2/10 Net 30 terms

Your 30-day action plan:

- Week 1: Implement one timing strategy

- Week 2: Add mobile-optimized invoicing

- Week 3: Set up systematic follow-up

- Week 4: Measure results and refine approach

The Technology That Makes It All Easier

Managing multiple timing strategies manually is overwhelming. InvoiceZap automates the entire process:

- Automatic Tuesday sending for optimal timing

- Mobile-first design that clients can pay instantly

- Built-in follow-up sequences that maintain professionalism

- Progress payment templates for complex projects

- Payment tracking that shows exactly what’s working

Ready to transform your payment timing? Download InvoiceZap and implement all seven strategies automatically. Turn payment delays from a constant worry into a competitive advantage.

These timing strategies work because they respect both business psychology and practical constraints. Start with one, see the results, and gradually implement others as they become natural parts of your workflow.

Ready to Streamline Your Invoicing?

Create professional invoices in 30 seconds with InvoiceZap's mobile-first design. No sign-up required.

Try InvoiceZap Free